3 Ways to Add Popular Crypto to Your Portfolio

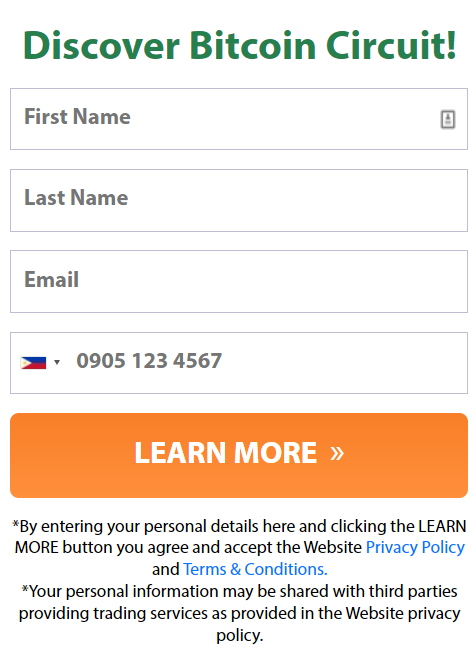

Bitcoin (BTC) which is a cryptocurrency, its price was introduced in the year 2009, after which it has seen huge fluctuations in its price, mainly it has been a roller coaster ride. Especially in the past few years, many traders have taken to the world of BTC. There are some who have made billions, while others have faced huge losses. Click this image below to start bitcoin trading.

If you too are considering adopting this decentralized version of digital cash, you also have a few different methods to purchase BTC that you can use. You can also take the help of traditional brokers or some new upstarts to buy them indirectly or directly. Although at present, it is considered easier to buy BTC than ever before, and it can also be bought at a lower commission than before. Here are the top three ways to buy BTC as well as some key factors you need to understand.

Factors to Consider When Buying Bitcoin

Before the purchase of bitcoin, everyone must be aware of the knowledge, smartness, and financial calculation involved in it. But preference should be given to the one which has some significant features like user friendly, restrictions with regulations, safety, and security along with a customer care facility before you start investing in the crypto exchange. Choice of exchange must be considered which is placed reputedly in the market no matter if it is payable for transactions. This is because a reputed platform will come with additional features such as security, and ease of operation, and offer the best deals for your investment as well.

Crypto exchange

Speaking of crypto exchanges, this is one option that may be popular for those looking to buy bitcoin. Generally speaking, some major benefits are provided to the traders by the exchange. On the other hand, if we talk about the best crypto exchange, then they offer the lowest possible cost for crypto trading. On the other hand, many exchanges do not charge any spread markup, which is usually a hidden fee in trading prices.

Third, although wallets are offered by many exchanges, crypto can be stored securely. Furthermore, fees are found to vary markedly on different crypto exchanges, so it may be worth your while to research which one offers the best combination of crypto choice, price, and service. Options such as Crypto.com, Binance, Coinbase, and Kraken are included in popularity.

Traditional brokers

Here if we talk about traditional brokers, they have also ventured into the crypto space including Tradestation and Interactive Brokers. The broker charges approximately $10.00 per futures contract, giving you exposure to a maximum of five BTC. In the event that you’re hoping to exchange BTC straightforwardly, you’ll have the option to pay a cutthroat commission of around 0. 10 – 0. 18% of your exchange esteem, contingent upon your month-to-month volume. In addition, you can also have access to ETH, BTC Cash, and LTC. With the help of Interactive Brokers, you can get a whole range of other tradable securities through which you will get access to securities from all over the world.

Trading apps

Coming to the trading apps, two apps are using which you will be able to pick up some BTC without any direct commission. One of which is Robinhood, an app that takes its best trick – no commission of any kind – and applies it to crypto, but doesn’t charge a spread markup, which is accurate. Cost not offered. You will be able to easily buy BTC directly and have access to other digital currencies as well. Another bull that allows you to trade over 25 cryptos including BTC. If you want, you can also choose a place to trade such as ETFs, stocks, and options.