Main Alphabet Investor Calls on Firm to Minimize Headcount and Pay

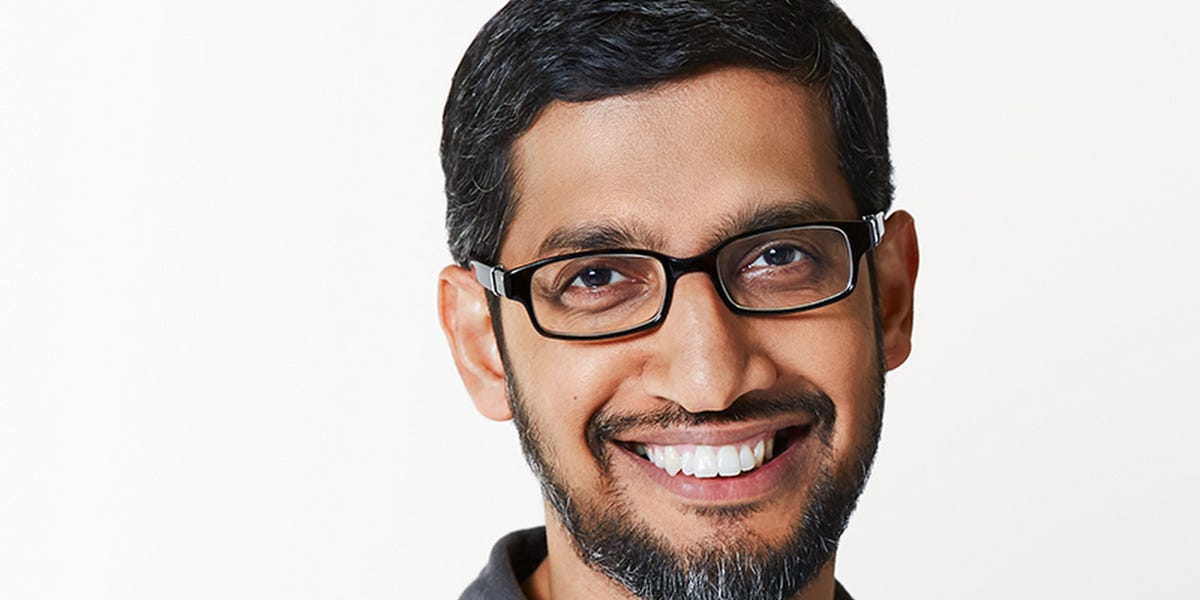

- Main Alphabet investor TCI despatched a letter to Alphabet’s CEO Sundar Pichai on Tuesday.

- The letter urged the corporate to chop prices partly by decreasing headcount and decreasing compensation.

- It additionally known as for losses to be “lowered dramatically” in Waymo, Alphabet’s self-driving automobile unit.

TCI Fund Administration, one among Alphabet’s prime traders, despatched a letter to the corporate on Tuesday urging it to slash prices by decreasing headcount, decreasing employee compensation, and curbing losses in long run bets like Waymo, its self-driving automobile unit.

The letter famous that “the price base of Alphabet is simply too excessive and administration must take aggressive motion.”

The London-based hedge fund has been a significant stakeholder in Alphabet since 2017, and stated its complete shares within the firm stack as much as $6 billion. Regardless of the dimensions of its investments in Alphabet, the Wall Road Journal noted that it’s “uncommon for large know-how corporations to face campaigns from activists comparable to TCI.”

The letter was addressed on to Alphabet’s CEO Sundar Pichai from TCI’s managing director, Christopher Hohn, who is understood in institutional funding circles for his activism.

Peter MacDiarmid/ Getty Photographs

Hohn famous that TCI was notably involved with how bloated Alphabet had gotten over time. Based on TCI’s calculations, which have been illustrated through color-coded graphs, the corporate’s headcount has grown at a charge of 20% per yr since 2017.

Over that point, Alphabet’s workers have greater than doubled from simply above 80,000 to shut to 190,000.

“The corporate has too many workers and the price per worker is simply too excessive,” Hohn suggested.

“It is a poorly saved secret in Silicon Valley that corporations starting from Google to Meta to Twitter to Uber might obtain related ranges of income with far fewer individuals,” Hohn added, quoting Silicon Valley investor Brad Gerstner. He additionally famous that TCI had held conversations with former Alphabet executives.

TCI was not solely vexed by Alphabet’s headcount, but additionally by the corporate’s above-market compensation charges. Hohn identified that median compensation at Apple was 153% larger than the 20 largest listed corporations within the nation.

“We acknowledge that Alphabet employs a number of the most proficient and brightest engineers, however these characterize solely a fraction of the worker base. Many workers are performing common gross sales, advertising and marketing and administrative jobs, which ought to be compensated in-line with different know-how corporations,” Hohn wrote.

Alphabet has introduced that it could be pulling back on hiring this year amidst increasing losses. Nevertheless, it has but to affix fellow tech giants like Meta, Twitter, and Amazon who’ve or are planning to institute huge layoffs this yr.

On the similar time, Pichai has echoed TCI’s sentiments on worker productiveness. At an all-hands assembly in August, he reportedly told employees that “there are actual issues that our productiveness as a complete will not be the place it must be for the headcount we now have.”

TCI issues, nonetheless, prolonged past Alphabet’s over-compensated and underperforming workers.

The fund known as for the corporate to scale back its losses in Different Bets, its division the place it invests in early stage initiatives which have the potential to usher in huge returns, like Waymo, biotech firm Calico, and later-stage enterprise agency CapitalG.

The payoff, nonetheless, has been underwhelming. In late October, the corporate reported $4.5 billion in losses from “Different Bets.”

TCI particularly pushed Alphabet to cull its funding in Waymo. “Sadly, enthusiasm for self-driving vehicles has collapsed and rivals have exited the market,” Hohn wrote. “Waymo has not justified its extreme funding and its losses ought to be lowered dramatically.”

Alphabet didn’t instantly reply to Insider’s request for a remark.

[Denial of responsibility! newsanyway.com is an automatic aggregator of the all world’s media. In each content, the hyperlink to the primary source is specified. All trademarks belong to their rightful owners, all materials to their authors. If you are the owner of the content and do not want us to publish your materials, please contact us by email – at newsanyway.com The content will be deleted within 24 hours.]