In What Way You Should Read a Credit Report?

A credit report provides a thorough history of a person’s credit. Your credit accounts, including credit cards, auto loans, house loans, and any other type of credit you have obtained from a licensed lender, will be listed in the credit report.

Additionally, information on payment history, credit limit and account balance, the opening date of credit, and the status of loans will be included in the credit report (close or open, paid in full, not paid in full).

A person who has filed for bankruptcy or a tax lien will also have their new credit inquiries, collection records, and public records included in their report.

What Qualities of a Report Ought You to Seek?

In the beginning, confirm that all of your data is accurate.

Then, focus on your credit history, particularly the “adverse accounts” portion, since it may reveal potentially damaging information like a past-due credit account or a bill that was sent to collectors and might damage your credit.

In addition, you can always use the service and make, for example, a 100 dollar loan direct deposit to improve your financial situation. But you should remember the conditions of the loan and the terms of its repayment.

You may notice mistakes in this section that you’ll wish to fix. Contact the creditor first, then the credit reporting agencies.

Among its resources for challenging inaccuracies are example letters, the Consumer Financial Protection Bureau is a government organization.

Act immediately if something appears to be a scam, such as a mortgage on a home you don’t own. Contacting the credit bureaus should place a fraud alert on your account.

The Federal Trade Commission and the police should both get reports from you.

In What Ways Is Your Credit Report Used?

When determining whether to issue a credit to you and under what conditions, lenders evaluate your credit reports as part of their review process.

Your credit scores are also determined using the data on your credit report.

Your credit reports may also be seen by potential employers and landlords who are deciding whether to hire you or rent to you.

When you apply for insurance coverage, a mobile phone contract, or other services like utilities, your credit reports may also be checked.

Obtaining Credit Reports

Every one of the main credit reporting organizations we just mentioned is required to provide you with a free copy of your credit report once a year. However, you have to request the reports; they aren’t automatically delivered to you.

Additionally, it’s wise to verify with all three as different information on you is kept on file by each agency.

You may even stagger them so that you receive a free report almost every three months if you play your cards wisely.

How to Interpret a Credit Report

Since each credit bureau prepares its reports differently, the items could appear in a different order, but they are all fundamentally the same.

Identifying Details

Your name history, current, and prior residences, phone numbers, birthdate, partially-masked Social Security number for security purposes, and current and previous employment are all examples of your personal information.

If your name appears in a couple of different places, don’t be shocked.

The variations of your name that you’ve used on credit applications will appear, including your married and maiden names, middle names with and without initials, the abbreviated form of your first name, etc.

It’s not a huge concern if one or more of your employers or phone numbers are missing. But be on the lookout for unfamiliar addresses, especially if you later discover unfamiliar accounts.

That might mean that someone opened bogus accounts in your name using your personal information. If you become aware of identity theft, report it right away.

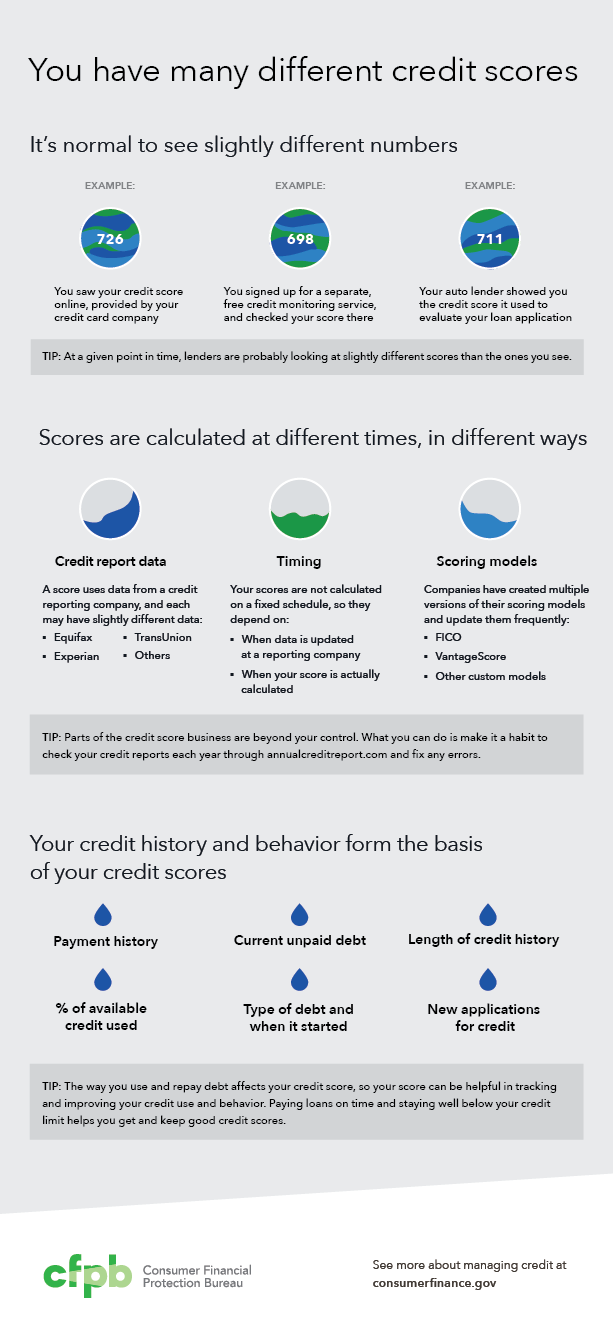

Also, don’t be alarmed when different landers show you different numbers. According to research by the Consumer Financial Protection Bureau, each lender has its payment methods, so results vary.

Earlier Employers

Employers from the past and present will be listed on your credit record. In the personal information area, employment history is occasionally mentioned.

Since your work history has nothing to do with your credit or debt, it has no impact on your credit score.

Finding inaccurate information, such as firm names you don’t know or employers you’ve never worked for, is cause for concern because it’s part of your credit report and is there to validate your identity.

Information about Inquiries

There are two categories of inquiries: “soft” and “hard.”

- “Soft” inquiries can be the result of you reviewing your credit reports, businesses making you pre-approved credit or insurance offers, or periodic account reviews by your present creditors. Soft inquiries do not affect credit scores, so checking your credit reports frequently is a low-risk method to keep track of your credit accounts, as well as a means to spot any strange behavior or erroneous or incomplete information that might be an indication of identity theft.

- “Hard” inquiries happen when organizations or people, such as a credit card company or lender, check your credit reports as a result of your application for credit or a service, like a new loan, credit card, or mobile phone contract. Up to two years, after they are made, hard inquiries might affect your credit ratings. The number of hard inquiries is simply one of the variables that affect your credit ratings.

Conclusion

Understanding how to read your credit report can help you keep a good credit score and understand how to improve your credit.

To prevent potential fraud and identity theft, you must periodically check your credit reports.

You can make better-educated judgments about your spending and borrowing habits after you get why it’s crucial to check your credit report and how to do so.