Top Information About Loans: Facts You Should Know

Can I cancel my credit insurance? How do people with bad credit histories get credit? Can I prepay installment loans? We’ve gathered ten popular questions about credit that users ask online.

Average American Credit Card Debt

Americans’ debt situation is getting worse every year. The average American’s credit card debt in 2003 was:

- Credit card debt $693 billion;

- TOTAL debt of $7.38 trillion.

As early as 2021, the average American’s credit card debt reached:

- Credit card debt $787 billion.

- Total debt $14.96 trillion.

The trend continues to get worse. Data source: Federal Reserve Bank of New York (2021). Debt statistics are from the second quarter of each year.

- You Can Get a Loan Even if You Don’t Have an Official Job

It turns out that some banks provide loans without a certificate of income, but you should not count on a large amount and low-interest rates in such a situation. It is best to apply to the bank where you have a debit card. Often, banks form special offers for their customers with more loyal requirements. This is especially true for online loans for bad credit.

But in any case, the borrower must have an income, albeit unofficial. If you have a source of income — no need to take loans, you need to live within your means. If you don’t have a source of income — you don’t need to take out loans, you are only driving yourself into a hole. Look for a better source of income.

2. What Documents of Unofficial Income Can I Submit for a Loan?

Some banks give credits, demanding the simplified set of the documents, where the income can be proved by the free form statement, under the bank form, by the account statement, or even without the proof of income. The total family income is also considered. Co-borrowers or mortgages will increase the chance of approval and allow you to take credit on more favorable terms.

3. You Can Get Rid of Credit Insurance

You just need to write an application and send it to the insurance company. Furthermore, you must attach a copy of the insurance contract to the application.

The company will return the money within 10 working days. If you want the money to be sent to a certain account, you should specify its details in the application. Keep in mind that if the contract has already begun, the money will be refunded after deduction of the services already rendered.

4. The Insurance Can Be Returned for Early Repayment of Credit

To begin with, you have to get a certificate from your bank stating that you have no debts. This document shall be attached to the application for a refund of the insurance amount. But the possibility of returning the insurance premium by the bank depends on the conditions of the credit agreement and the insurance contract. One of three situations is possible:

- in the first case, you will be entitled to a refund of the full amount of the paid insurance premium without commissions and deductions;

- in the second case, the bank will make a partial refund, i.e., the amount proportional to the period of using the insurance services;

- in the third case, the insurance amount is not refunded at all. This situation is possible if the insurance contract states that for early payment of credit to the client is not returned the amount of insurance premium paid. In this case, the client has the full right to apply to the court.

5. You Can Take a Loan Against the Pledge of Real Estate Owned by Proxy

It all depends on the powers that the owner has given to a person to dispose of his property.

If there is a right to dispose of the property in the form of its pledge to the creditor in the power of attorney, you are entitled to rely on obtaining a loan on the security of real estate, the owner of which is not. It should be understood that the more specifically described in power of attorney cases for which the owner gives you the right to pledge his property, the fewer questions the lender may have.

Don’t forget to get your spouse’s consent and permission to put the property in escrow.

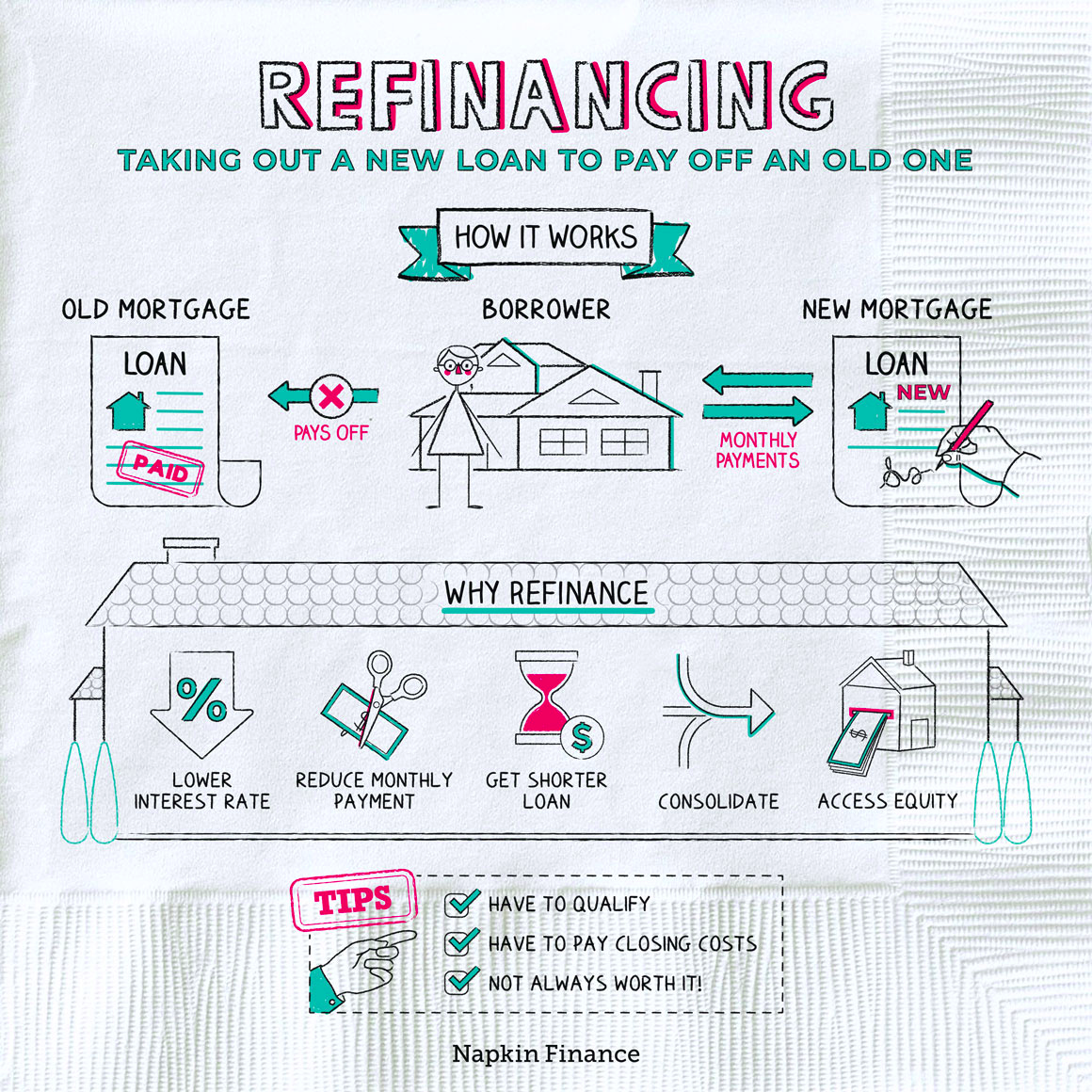

6. It is Possible to Refinance a Recent Loan

Yes, but it is a very specialized offer on the market. The majority of them require that the borrower makes at least 3/6 payments on the existing loan. But the main requirement for refinancing all banks is the absence of late payments on current obligations.

7. Repay the Installment Early

An installment received from a bank is a credit. The bank cooperates with the store. And the store gives the client a discount on the goods in the amount of the interest accrued on the credit.

8. You Can Get a Loan Even if You Have a Bad Credit History

Borrowers with a bad credit history have the best chance of getting a credit card. So if you want to make up for past mistakes and improve your credit history, it might be worth trying to get a card from a bank with a loyal risk strategy first and using it carefully for a couple of years. A fresh history of on-time payments will help improve your reputation in the eyes of potential lenders and increase your chances of getting a larger loan.

9. What Should I Do if a Debt Collector Calls and Threatens?

If the collection company violates the law, the debtor should first collect maximum evidence of the violation — call details, audio recordings of conversations, photos of messages. Also, it is worth contacting the prosecutor’s office.

The borrower can also state refusal to interact with the creditor and his representative by registered mail with a list to the legal address of the creditor.

But! If your only home is a mortgage, it is excluded from the list of properties that the lender has no right to foreclose on. Therefore, if bailiffs are trying to put your apartment for sale, and it is not in the mortgage, then feel free to write an application to cancel the decision of the bailiff regarding the sale of your apartment. The same goes for those who are or plan to declare bankruptcy. Write an application to the court to exclude the property from the bankruptcy estate.