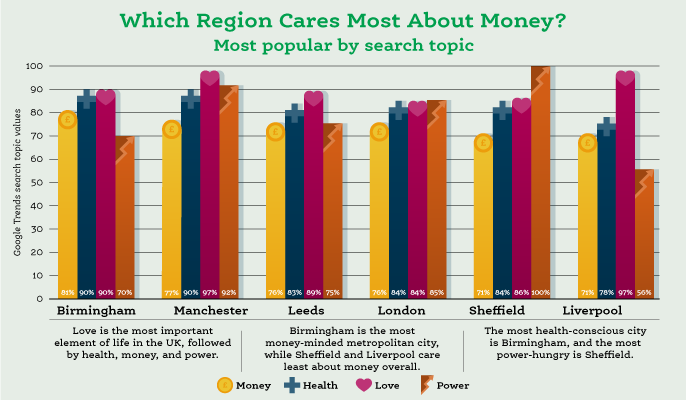

Brummies care most about money in the UK, new research finds

· Birmingham is the most money-minded city in the UK

· Sheffield and Liverpool care least about money

· Those from the capital are most likely to care about money over love

· People from Liverpool and Leeds are more likely to favour wealth over health

Does money really make the world go around? To find the answer to this age-old question, Equity Release Supermarket analysed six of the most populous metropolitan cities in the UK to see how searches for ‘money’ compares against life’s other necessities like love, health, and power.

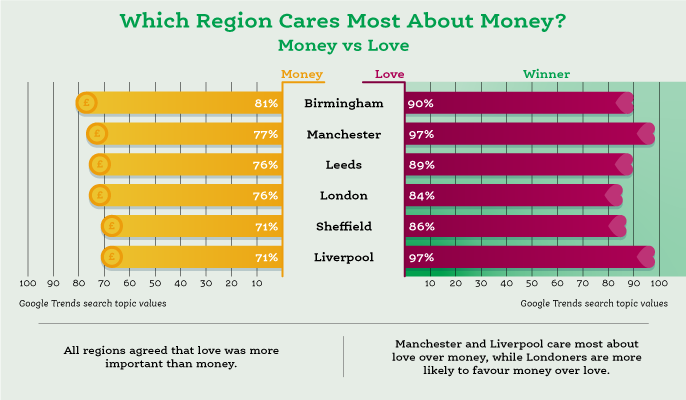

Although ‘money’ searches paled in comparison to ‘love’ searches. Every region analysed cared more about love than money, with Liverpool and Manchester leading the charge (both received 97 per cent of aggregated ‘love’ searches). Those from the capital are most likely to care about money over love.

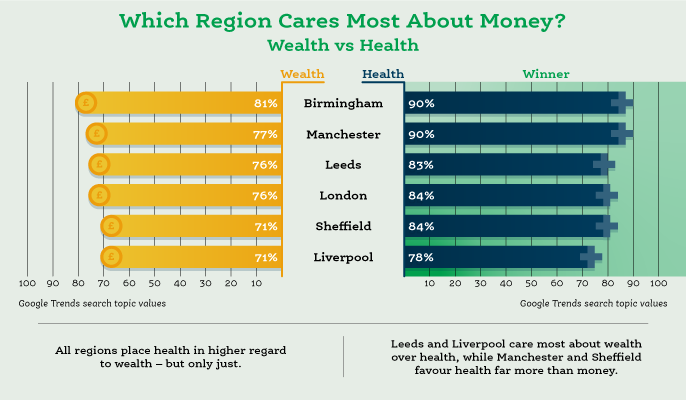

All regions considered health to be more important than wealth – but only just. And not all regions agreed. For instance, the data found people from Liverpool and Leeds are more likely to favour wealth over health.

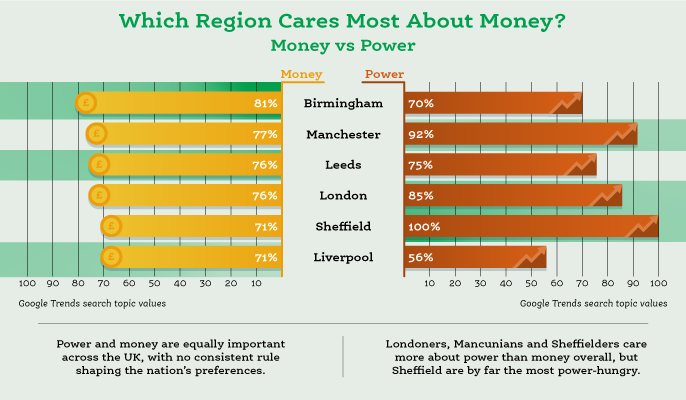

Health is a clear 2nd priority for Brits after love, except for Sheffield. The data shows that Sheffielders care more about power than anything else, reaching 100 per cent aggregated ‘power’ searches when compared against the other regions.

“Whether resplendent in wealth or watching the pennies, it is fair to say that every Brit has money on their mind. Of course, knowing how to spend – or save – it is entirely in the hands of the earner.

“For some, that could mean saving up towards the first post-Covid holiday (finally!), putting some cash aside for the future or siphoning off your salary each month to pay off that mortgage – however you use it, the idiom is true: money really does make the world go round, as our research has found.

“It is reassuring to know how much Brits really do care about money when searching online, as being financially secure in retirement doesn’t simply start from the date you receive your pension – it’s a lifetime in the making!”