Press Releases

How UK Travel-Tech Startup Finds New Path After Double Hit of COVID-19 and Government Action

Background:

Back in September 2020, the UK government decided to end VAT-free shopping for international visitors from 2021. The heads of firms such as Marks & Spencer, Heathrow and Selfridges said the move also put 70,000 jobs at risk*. UK retailers, tourism businesses and airport operators were seeking legal advice after the “body blow” of a government decision to scrap value added tax relief for overseas visitors**. This decision not only hit UK retailers and airports during the pandemic, it also dealt a huge blow to UK travel-Tech startup, Wevat.

Back in September 2020, the UK government decided to end VAT-free shopping for international visitors from 2021. The heads of firms such as Marks & Spencer, Heathrow and Selfridges said the move also put 70,000 jobs at risk*. UK retailers, tourism businesses and airport operators were seeking legal advice after the “body blow” of a government decision to scrap value added tax relief for overseas visitors**. This decision not only hit UK retailers and airports during the pandemic, it also dealt a huge blow to UK travel-Tech startup, Wevat.

What does Wevat do?

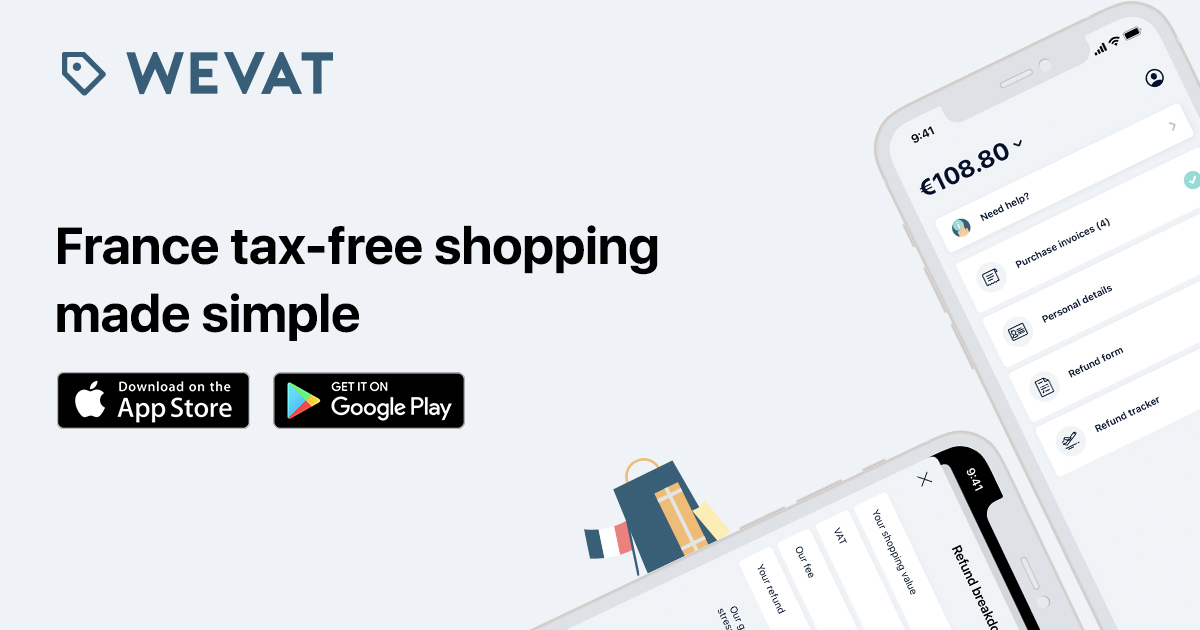

Wevat, a London based travel-tech startup, is on a mission to make tax-free shopping simpler for overseas travellers visiting Europe by changing government policy and enabling travellers to do it easily using an app.They believe time and money should be saved on travelling and shopping during the trips.

Wevat, a London based travel-tech startup, is on a mission to make tax-free shopping simpler for overseas travellers visiting Europe by changing government policy and enabling travellers to do it easily using an app.They believe time and money should be saved on travelling and shopping during the trips.

Double hits: COVID-19 and Government Action

Wevat started in the UK. In 2019, it grew the team to 22 and by the end of 2019, when Wevat had launched for less than a year, they had already acquired 70,000 users from over 88 countries, who claimed VAT refunds on more than €18 million of purchases. However, like the majority of companies in the travel industry, 2020 posed a tough challenge, and especially so for Wevat because on top of COVID-19, HM Treasury abolished the VAT refund scheme altogether in a cataclysmic move that shook up the retail industry from West End to Bicester Village.

Travel-tech startup finds new path:

God doesn’t close one door without opening another. However, one of the great things about post-Brexit travelling in Europe is that British travellers can now claim a VAT refund on purchases made in the EU! This includes popular holiday destinations like France, Italy and Spain. After all this time, Brits can finally benefit from tax-free shopping in Europe.

So, far from giving up, Wevat quickly pivoted to set up in France, and have now obtained the license to offer a fully digital VAT refund service in France, which Wevat will launch later this year under the banner of becoming “the go-to shopping app for your next trip to France”.

Wevat’s impressive track record and resilience in the face of adversity also won Raphael Chow, CEO & Co-founder, a place on the Forbes 30 under 30 Europe list in April this year. What Wevat has come to symbolise is that perseverance and resilience through technology, innovation and principles pays off. And though there is a long road yet ahead to success, Wevat hopes to share their story as a source of inspiration for fellow travel startups.

About Wevat:

Wevat was founded in London in 2016 as the first digital VAT refund provider for international travellers. So far, they’ve helped travellers from 88 countries get a tax refund on more than €18 million of shopping.

Wevat aims to make the tax-free shopping experience convenient, efficient and reliable for travellers with its revolutionary digital solution and customer-focused service. The company believes getting tax back on your shopping should be simple and hassle-free, so you can spend your time and money on better things. Wevat is launching its service in Europe to let travellers shop tax free on the go in France.

Wevat is backed by experienced investors including Entrée Capital, firstminute Capital, Sweet Capital, and Andy Phillips, former CEO of Priceline (part of Booking Holdings Inc.). They also have strong partnerships and seamless integrations with innovative payment providers such as Alipay and WeChat Pay.

Wevat’s Mission:

Traditional refund companies sign up retailers who hand out paper refund forms to travellers. This resulted in high commissions that are paid to the retailer, which in turn produces high admin fees that are passed on to the consumer. Wevat pioneered the first-ever B2C app in the UK which travellers could download and use directly – without going through another middleman. This means they can refund much more, on average 23% more, and also do so in a seamless, convenient journey that no longer requires manual paper forms to be filled with the same details again and again. The digitised process was designed with the traveller in mind and had one goal: to save them time and money.