Quanloop experience 2020 – stable growth for investors

2020 was a very challenging year for many investment platforms. Some dissipated into oblivion, some managed to operate stably while others experienced massive growth. Quanloop – the alternative to a savings account – has shown a brilliant stability perfect growth of passive profit to its investors. Below are the figures of Quanloop’s financial performance of 2020.

| Projects funded | 183 |

| Average loan principal | €9,870 |

| Interest paid out to investors in total | €66,722 |

| Other profits (Cashback to cover inflation loss) | €11,960 |

| Average interest rate | 13.7% |

| Borrowed from investors daily | €0.95M |

Indeed, this does not end here, and they intend to expand. By mid-December 2020, Quanloop’s leveraged capital exceeded by €1M and is growing steadily.

Quanloop (Quanloop Usaldusfond) is an Estonian investment fund, founded by Valentin Ivanov. Their business model involves pooling capital from investors and investing it in projects presented by their professional partners. Although, it sounds like a common P2P lending platform – it is not. Quanloop is the sole borrower and the loan-originator. Investors sign-up and put money in their Quanloop clients’ account, allocated in the Estonian local bank. This money is not to be used to cover Quanloop’s debts. It will be returned immediately in case of insolvency.

Quanloop is listed in the Estonian business register under the code 14496178. Its assets are managed by Quanloop Group OÜ and supervised by Estonian fund manager Bondkick. The latter is governed by the Estonian Investment Funds Act 2016, and it holds a financial licence (FFA000250).

The capital Quanloop pools are used to invest in projects with higher interests in exchanging assets from the partners to be used as collateral for the investors. Once the partners pay back the credit, Quanloop pays its investors their profits. If they fail to pay, then Quanloop ceases the assets and liquidates them to pay its investors. It should be noted that none of the partners is consumer, but a European firm based in France, Spain, Finland, Latvia, Romania, Greece and Estonia.

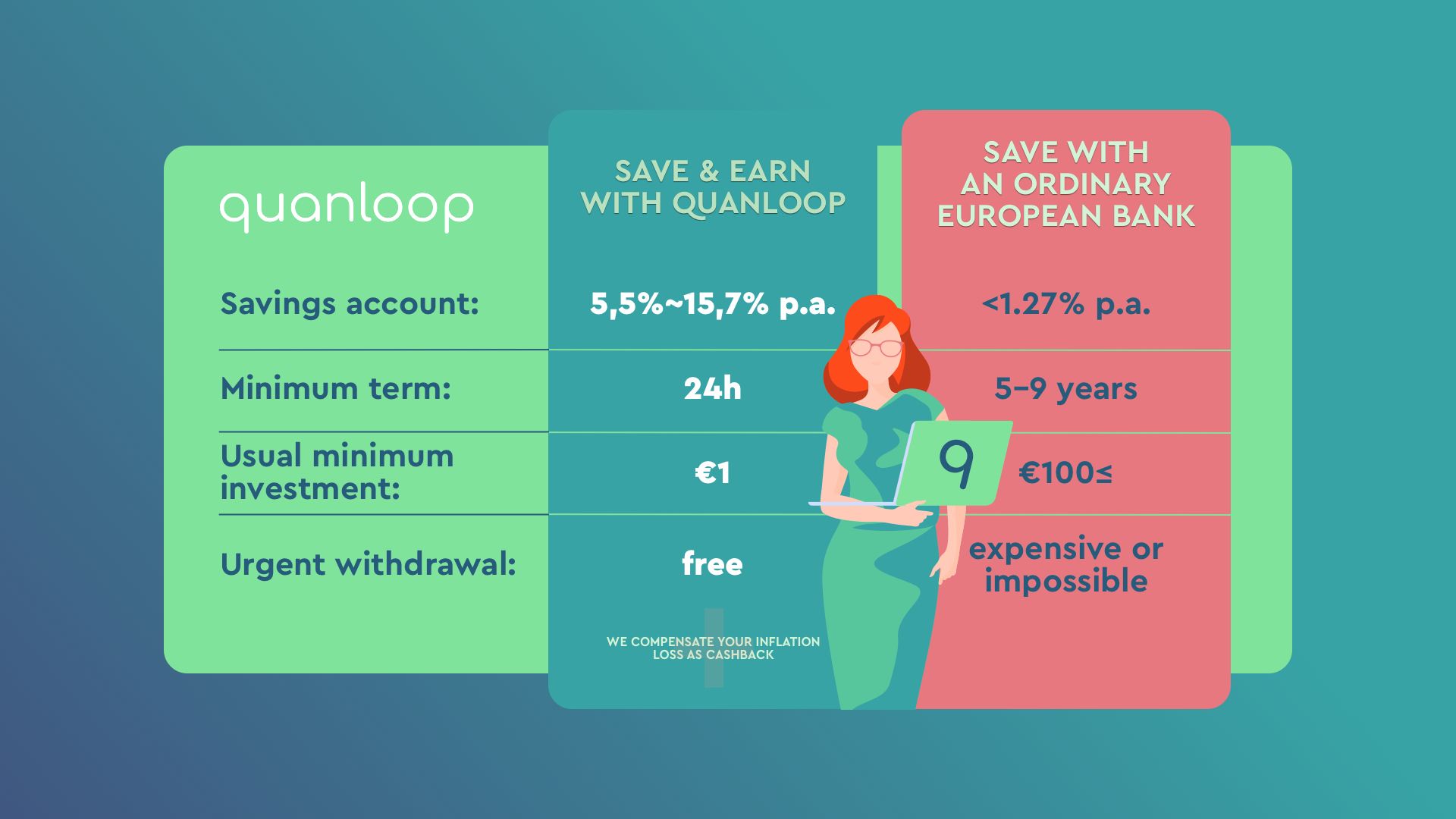

Investors can enjoy a regular income due to Quanloop’s selective choice in its partners. Exiting early is free and fast – taking only 24 hours – due to its capital reserves. Taxes (20% in Estonia) are paid on the investors’ behalf if they are citizens or residents in Estonia or if they hold an Estonian Tax Identification number. Investors can also take advantage of their referral bonus (2.5% of there referee’s profits), a sign-up bonus (5 Euros) and their unique cashback program which compensates for the inflation loss in Europe.

In conclusion, all investments carry risks, and Quanloop admits that they are not an exception. However, it has proven itself as a platform that understands the risks of alternative investments and adopts measures to stabilize it as much as possible without sacrificing the returns, high liquidity and ease of exit. It does not promise unrealistic results, nor does it sink too low for investment to be worthless. Covering all grounds for an investor, Quanloop stands as an all-rounder in the field of alternative investment.