Are Rental Costs in the UK Becoming Unmanageable?

New 2024 data, assessed by LandlordBuyers.com, demonstrates that private rental prices have increased over the past year across England (8.5%), Wales (8.5%), Scotland (7.6%) and Northern Ireland (9.9%).

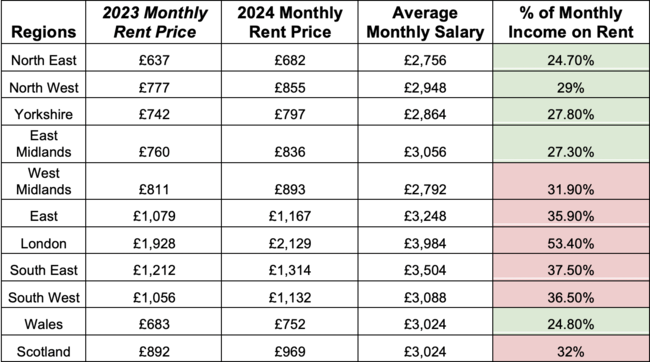

It is widely advised that tenants allocate no more than 30% of their monthly salary towards rent. Despite this, in the following areas, renters are spending significantly more than this benchmark:

- London = 53.4% of salary on rent

- South East = 37.5% of salary on rent

- South West = 36.5% of salary on rent

- East England = 35.9% of salary on rent

- Scotland = 32% of salary on rent

- West Midlands = 31.9% of salary on rent

This is in stark contrast to regions where renters spend below the 30% threshold on rent:

- North East = 24.7% of salary on rent

- Wales = 24.8% of salary on rent

- East Midlands = 27.3% of salary on rent

- Yorkshire = 27.8% of salary on rent

- North West = 29% of salary on rent

Speaking on the state of the UK rental market, Jason Harris-Cohen, Managing Director of LandlordBuyers.com, noted: “A North-South divide definitely still exists but the divide is tapering. Only in mid-September did estate agent Hamptons release data that showed the gap between rental values in the North and rental values in the South of England has narrowed to its lowest point in over a decade,” says Jason. “In fact, while it was still more expensive to rent in the South, Southern rents were only 37% more expensive than those in the North – down from 43% more in August 2023 and a peak of 55% more in November 2021.”

According to Jason, the future of the rental price gap will hinge on various factors. “One will be landlords themselves: which ones decide to exit the market and where their rentals are geographically located. Buy-to-let professionals are holding their breath ahead of autumn’s Budget. If pockets of landlords, perhaps mainly in the South, decide to sell, we could see supply restricted, values rise and the gap widen again.”

He adds: “Conversely, if Labour gets to grips with levelling up, we may see the appeal of Northern towns surge, wages catch up with Southern counterparts and demand for property – both to buy and rent – increase.”

Jason further comments that house prices will also influence the market: “House prices will play their part too. Stagnating property and rental values in the South have been blamed for the rental value slowdown, whereas house price growth in the North has been broadly strong. If this trend continues, we could see Northern values increase further and approach something more like rental equilibrium across the country.”

“When comparing average salaries to rental prices, the figures indicate an ongoing imbalance. Although the Office for National Statistics reported wage growth at 5.1% over the three months to July 2024 – surpassing inflation at 2.2% – Goodlord found that the average cost of a new rental home in England was 7% higher in August 2024 compared to August 2023.”