The Crypto Conundrum: Can Digital Assets Ever Truly Replace Fiat Currency?

The emergence of Bitcoin way back in 2008 sent tremors through the global financial system. Here was a currency, conjured not from paper and ink but from lines of code, operating outside the control of governments and financial institutions. It promised a future of decentralised finance, free from the perceived shackles of traditional monetary systems.

However, well over a decade later economists, investors and even your average Joe down at the bar are still posing the question that sparks fierce debate and speculation: can digital assets ever truly replace fiat currency, or will they remain a niche phenomenon within the broader financial ecosystem?

Old Money, New Problems?

To understand the allure of crypto, and why it generated such a shockwave, it helps to understand the frustrations with what came before. Fiat currency, backed by governments and their promises, has been the bedrock of global finance for centuries. But let’s be honest, the system is showing its cracks- and that’s putting it mildly.

Inflation, that insidious beast, eats away at our savings, while governments and central banks tinker with interest rates and money supply, leaving everyday folks feeling powerless. A quick look at recent inflation data coming out of the G7 economies like the UK and the US paint an ugly picture, whilst quantitative easing is being rolled out at a nearly unprecedented rate.

Away from the standard monetary policy instruments, many people are also seriously starting to question why our financial systems still relies so much on outdated infrastructure and a labyrinth of intermediaries, particularly whilst emerging technologies such as AI are developing at a breathtaking rate.

Just ask anyone who’s tried to send money overseas and found themselves grappling with confusing processes and exorbitant charges to get a taste of the appetite for change.

The Siren Song of Decentralisation

Enter cryptocurrencies, with their promise of a decentralised financial utopia. Transactions, etched onto the blockchain for everyone to see, cut out the middlemen – and their fees. This transparency also reduces the risk of fraud, making it a compelling proposition for those wary of traditional financial systems.

But the appeal goes beyond practicality. For many, crypto represents financial freedom, as well as freedom from government meddling, censorship, and the whims of centralised institutions. It’s a particularly seductive narrative in regions grappling with political instability or restricted financial access, which is countries like El Salvador have embraced Bitcoin as legal tender.

Imagine a world where citizens can escape hyperinflation or government seizures of assets with a few clicks on their phone, their wealth safely stored in a digital wallet beyond the reach of authoritarian regimes.

Then there’s the ‘digital gold’ narrative surrounding altcoins including Ethereum and of course Bitcoin. With its fixed supply, Bitcoin is touted as a hedge against inflation. Unlike fiat currencies, subject to the whims of central banks, Bitcoin’s value is, in theory, immune to inflationary pressures. This has made it a favourite among those seeking to safeguard their wealth against economic uncertainty, particularly during times of geopolitical turmoil or market volatility.

The Roadblocks on the Path to Main Street

Despite the hype and potential, according to some finance commentators cryptocurrencies face a steep climb before they dethrone fiat currency. Volatility is always bought forward in evidence by crypto detractors- their naysaying amplified by headline grabbing fluctuations. For example, in September 2020, the price of Bitcoin was hovering around $10,000, but by April 2021, it had shot up to over $60,000, only to drop below $30,000 a few months later.

These same detractors also like to pose a series of hypothetical scenarios that really have very little basis in fact. A quick look on popular social platforms like X and you’re likely to stumble across plenty of questions along the lines of: Would you want to buy a coffee with Bitcoin if its value could plummet before the barista hands you your change? Some anti-crypto advocates also like to conjure up a world where your weekly grocery bill fluctuates wildly depending on the whims of the crypto markets.

However, such radical predications have not been realised in places like El Salvador and it’s very difficult to say how economies more broadly would react to omnipresent crypto adoption; there would have to be an adaptation and mechanisms would certainly be put in place

Once such mechanism that perhaps hasn’t garnered enough merit or attention is the role of stable coins. Trusted crypto advice platform cryptoinvestmenthq.com defines stablecoins as a type of cryptocurrency whose value is pegged to another asset, such as a fiat currency or even gold, to maintain a stable price.

Then there’s the issue of scalability. While crypto enthusiasts rave about the speed and low cost of individual transactions, some blockchain networks struggle to handle the sheer volume of transactions required for global commerce. However, this is changing and exciting developments like those pioneered by Ripple (XRP) give a glimpse into what could be possible in the not-too-distant future.

To Regulate, or Not to Regulate? That is the Question

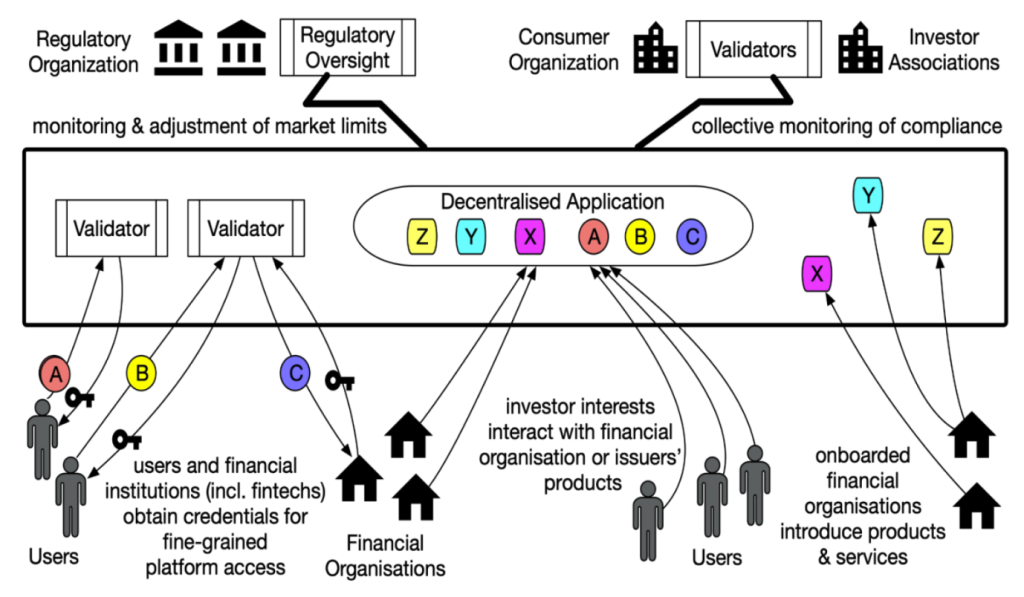

The very thing that makes crypto so appealing – its decentralised nature – is also a source of anxiety for governments worldwide. Accustomed to controlling the flow of money, governments are scrambling to figure out how to regulate this new breed of financial asset. After all, how do you regulate a system that was designed to operate outside traditional financial structures?

On the one hand, clear regulations could be a boon for crypto, fostering trust and encouraging institutional investment. A well-defined regulatory framework, such as those proposed by the IMF, could provide much-needed legitimacy to the crypto space, attracting institutional investors and paving the way for wider adoption. On the other hand, overly burdensome regulations could stifle innovation and drive crypto development underground. If governments approach crypto with a heavy hand, it could stifle the very innovation that makes this technology so promising. It’s a delicate balancing act, and the outcome will likely determine the extent to which cryptocurrencies can integrate into the mainstream financial system.

Adding another layer of complexity is the environmental impact of crypto mining. Proof-of-work blockchains, like the one underpinning Bitcoin, are notoriously energy-intensive. The process of mining Bitcoin, which involves solving complex mathematical problems to validate transactions, requires vast amounts of computing power, and therefore, energy. As environmental concerns take centre stage, cryptocurrencies will need to find ways to reduce their carbon footprint or risk facing a backlash from environmentally conscious consumers and investors. The emergence of more energy-efficient consensus mechanisms, such as proof-of-stake, offers a glimmer of hope, but the industry still has a long way to go to shake off its reputation as an environmental drain.

A Future of Coexistence?

So, will we soon be paying our taxes in Bitcoin? While the future remains unwritten, a complete overthrow of the existing financial system seems improbable, at least in the short term. The challenges facing crypto are significant and will require innovative solutions. Governments are unlikely to relinquish control of their monetary systems overnight, and the volatility of cryptocurrencies, although set against a positive outlook, does need to be addressed.

However, dismissing crypto as a passing fad would be foolish. The technology underpinning cryptocurrencies holds immense promise, with the potential to revolutionise everything from supply chain management to digital identity verification. As blockchain technology matures and cryptocurrencies evolve, we may well see a future where digital assets and fiat currency coexist, each serving different needs and purposes.

Imagine a world where you could use crypto for cross-border payments, taking advantage of its speed and low cost, while still using fiat currency for your everyday purchases. Or perhaps you’ll hold a diversified portfolio that includes both cryptocurrencies and traditional assets, hedging against inflation and economic uncertainty.

In this hybrid financial landscape, central bank digital currencies (CBDCs) could emerge as a key player. It’s not too far-fetched to envisage digital versions of existing fiat currencies, backed by governments but powered by powerful technology. This could provide a bridge between the traditional financial world and the burgeoning crypto ecosystem, offering the benefits of both worlds. CBDCs could potentially offer faster transaction speeds, lower costs, and greater financial inclusion, all while remaining under the control of central banks.

Ultimately, the future of money probably lies in a blend of the old and the new. As we navigate this uncharted territory, one thing is certain: the future of finance will be anything but boring.