Airline stocks: Plane your gain

Airline industry became one of the most affected by the Covid-19 pandemic. No surprise there, really – what’s the point in buying tickets if you can’t fly? Therefore, every piece of positive news related to the pandemic gave a powerful boost to airline stocks. But what’s going on with these stocks now, when Covid is fading into the background. What shares have the most potential according to analyst opinions? Let’s figure it out.

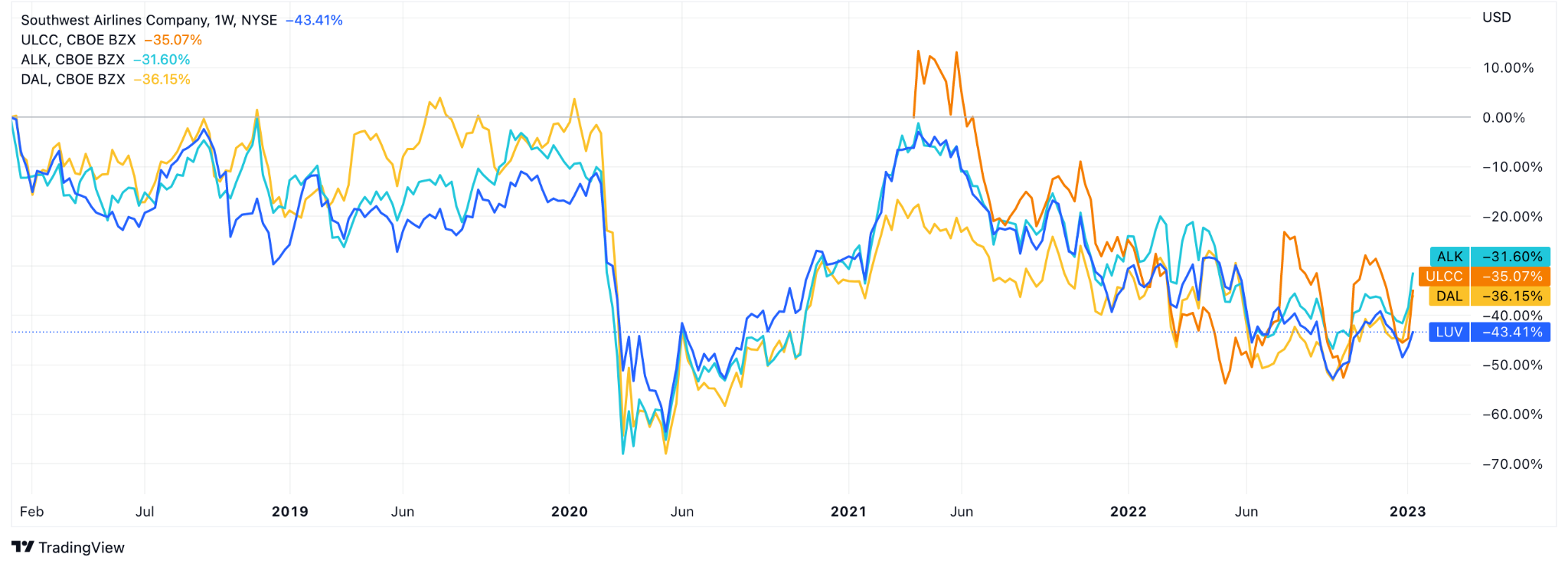

First, let’s take a look at the chart below. It grants fantastic insight into airline stock movements over the past few years. Here you will find Southwest Airlines, Delta Air Lines, Alaska Air and Frontier. If you want to make your own list of stocks sorted out by defined parameters, you can always use Stock Screener. But let’s get back to the matter at hand.

As we can see, the shares came back to the pre-pandemic level in the middle of 2021. And since then have been slowly moving down together with the whole market. But here and now we want to show you how much the stocks you can see on the chart above might hike in the next 12 months.

The first one on the list is Frontier. It’s a super ultra low-cost carrier. The company has a cost-effective business model based on a single family of aircraft, a fuel-effective fleet and ticket sales with low distribution costs. Analysts are impressed by the Frontier development, therefore the consensus forecast for the stocks is +51% in the next 12 months.

Southwest Airlines is one more American low-cost carrier on our list. At the end of 2022, the stocks of the company dropped significantly – the decrease amounted to 19%. Since the new year, the stocks have partially recovered, but it’s still not looking great. The main reasons for the drop are massive flight cancellations during the Christmas holidays, coupled with obsolete software that stranded thousands of passengers during one of the busiest travel weeks of the year. In any case, the analysts believe that the carrier will be able to handle these issues. The consensus forecast is +28% in the next 12 months.

The next company that is likely to show good results in the market is Delta Air Lines. Unlike the previous industry members, this one is a colossus – it’s one of the biggest airlines in the world. Stock of this air carrier has hiked 15% over the last month and analysts believe that this trend will last. By their average forecast, the shares will increase by nearly 32% over the next year.

Alaska Airlines is working on transforming their fleet. The company plans to have an all-Boeing mainline fleet by the end of 2023. This transitional period bears pressure upon the Alaska Airlines stock, but the experts think that 2023 may bring luck to the carrier. Analysts believe that the share might show 24% growth in the next 12 months.

All these forecasts indicate that there’s profit to be made by buying tickets for “airline market” flights. But don’t forget to do your own analysis before you decide to buy or sell any assets. This is rule #1 for any successful trader or investor. Ladies and gentlemen – fasten your seat belts, please. We’re almost ready for takeoff.