Banking without Banks: Decentralized Finance

Could anyone imagine that the need for brokers or banks would disappear? Probably, most people still believe that the financial industry cannot exist without these two institutions. But in fact, with the development of blockchain technologies, everything impossible becomes possible.

Such a financial market has become a reality thanks to the evolution of decentralized finance. With its help, all products based on tamper-proof smart contracts can directly interact with the blockchain ecosystem. Now there is no need for intermediaries.

If crypto investors are interested in DeFi technology, they need to understand that all interaction is based on tokens issued by individual companies. Becoming a part of something like this is quite simple. People need to use the stableswap DEX and exchange their stabilizers for specific tokens. If you are interested in decentralized finance, you should continue to read on to learn more about the prospects for investing in this technology.

https://appinventiv.com/blog/decentralized-finance-defi-guide/

What is decentralized finance?

In simple words, DeFi is a radically new monetary system that is built on public blockchains. This technology consists of many different components. The main ones are dApps, smart contracts, digital assets, and protocols. Crypto enthusiasts are familiar with cryptocurrencies like Ethereum or Bitcoin. They represent a vast digital network where anyone can create unique financial products.

Thanks to the use of open-source, companies can conduct financial activities without the participation of regulatory bodies and centralized institutions. Only the most mainstream ecosystems have been named above, but there are many more, such as Polygon, Solana, and others.

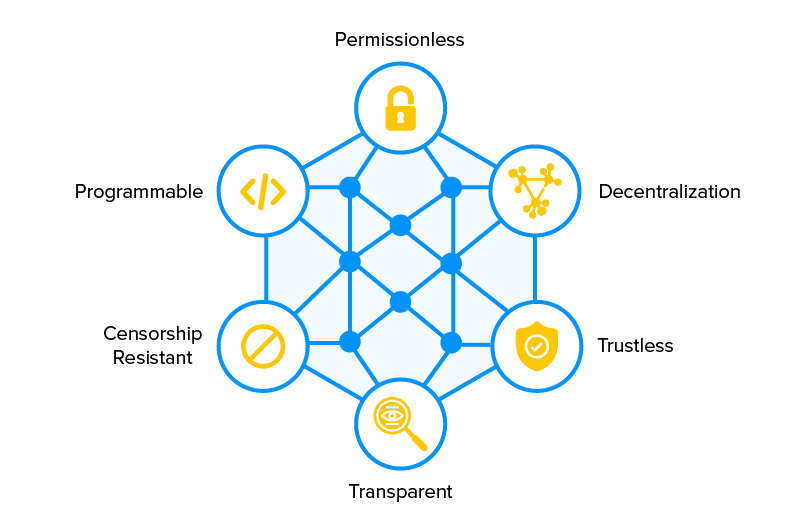

People who cannot access essential financial services can take advantage of the tools through DeFi. They no longer need to obtain permission from banks to conduct transactions or other operations. The entire system is decentralized, which allows not only to speed up the interaction process between different users but also to ensure complete security of data and assets.

DeFi vs Traditional Banking

DeFi is just a more advanced finance structure that works on the same core. The main instruments are lending money, borrowing, and earning income from holding assets. Several unique features allow decentralized finance to win over traditional bank services. Below, you can find some of the benefits that this technology offers.

- Any institutions do not run DeFi. All control occurs due to algorithms written in smart contracts. This means that the system can work autonomously without additional intervention.

- Full transparency. Unlike traditional finance, DeFi owns the transparency code. Anyone can analyze and verify the reliability of a particular product. The issue of confidentiality and security of digital assets should not arise, considering that each transaction is completely anonymous.

- The ability to interact directly with the system. People don’t have to go through nine circles of hell to create financial products. Every crypto enthusiast can interact with smart contracts from crypto wallets. They can create your technologies, access to which will have everyone.

- Mix of technologies. Creating new products in DeFi is a bit like Lego. Developers can mix prediction markets, decentralized exchanges, and stablecoins to create something radically new.

DeFi wins traditional finance in most aspects. All processes are much more accessible. Investors do not need to spend a lot of time and effort conducting a transaction or using any banking instrument. Everything happens simply, quickly, and reliably.

What are the benefits of DeFi?

Traditional banks are costly. For each transaction, people need to pay large sums of money. Such institutions drive people into the framework because of the massive list of rules and restrictions. This does not allow clients to feel free and do what they want. DeFi is the complete opposite. Users do not need to obtain any permissions to conduct financial transactions. All that is required from the client is access to the Internet and a computer.

People can decide the fate of their digital assets. Clients are not required to trust their money to someone else. In addition, the ability to quickly introduce new products and interact with third-party programs opens up many new possibilities.