How to Use Personal Loans and Not Fall into Debt Trap

There are a lot of guides on coming out of the debt trap, but why don’t you think about avoiding it in the first place? One bad decision after another, and you are doomed to spend a lot of time and waste a lot of opportunities on your way out of this debt hole.

We compiled these recommendations to warn you about the common mistakes and give an example of responsible financial behavior. Follow our tips to reduce the risk of getting trapped if you have to use loans.

What Is a Personal Loan

The name stands for itself: personal loans are the money received from a lending organization that you can use for any personal purpose. Usually, the sums are much lower than in the case of business loans.

And the procedure of applying and getting the money to your account is much easier. In some cases, the whole process takes less than 24 hours.

There are several classifications of personal loans based on various criteria:

Depending on the required collateral:

- secured loans need some insurance in the form of valuable things and possessions;

- unsecured loans don’t require any collateral.

Depending on the purpose:

- vacation loans;

- wedding loans;

- consumer loans;

- debt consolidation loans, etc.

Depending on the terms:

- short-term;

- long-term.

Depending on interest rates:

- fixed-rate;

- adjustable-rate.

The bottom line is the personal purposes of using the money and short or moderate terms.

Why It Is Important To Be Careful While Taking a Personal Loan

Loans provide a tempting opportunity to get all you want immediately. It’s really easy to fall into the deceptive feeling of availability of valuable items. The clouded prospects of paying back the debt are not scary enough.

Remember, when during the process of your application, the bank considers only your stated income and other debts. You can also find one of the loan places online only direct lenders there provide money support.

Other factors are not accounted for in the calculation. But what if you lose your job or experience a salary cut? Will you be able to pay installments in time? Pay attention to such factors, applying for a loan.

Credit cards require careful handling because it’s extremely easy to accumulate an enormous debt through multiple small purchases. The same is true for small consumer loans, which can sum up to a significant figure at the end of the month.

We recommend considering the worst-case scenario when making a decision to apply for a loan. If you are still able to pay it back, go ahead. But if there are any doubts, it’s better to stop and find another money source.

What are Personal Loan Requirements

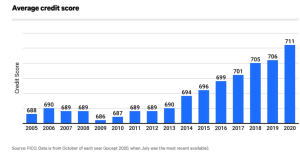

The first thing every lending organization takes into consideration is your credit history and score. In September 2020, more than 38% of USA citizens had a geo-credit score of A to E, which corresponds to a traditional credit score of at least 740. Only approximately ten percent had geo-credit scores of P to T (539 or below).

Source: valuepenguin.com

The second important factor is your income. According to it, the lender will calculate the maximum amount of money you can receive. Many lenders don’t tell about the minimum income they require to approve the application; it’s normal practice, so don’t be surprised.

Bank may ask for your tax returns or a bank statement to confirm the income you stated in the application.

The lender will also make checking of other debts you have and evaluate possible collateral. On the basis of these criteria, the lender will approve or deny your application and calculate the interest rates and terms of the loan.

How APR Is Calculated

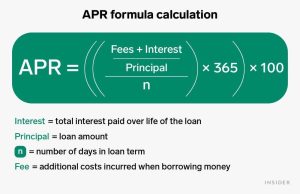

The annual percentage rate is the amount of money you should pay for the loan each year. It’s calculated according to the total loan amount. It’s an essential factor that raises the cost of the thing you buy, so you have to know the APR of your credit cards and loans you use. For example, if the APR of your credit card is 12%, you will pay $120 a year for every $1000 you borrow. Obviously, the lower the APR, the more beneficial the offer, if other parameters are the same.

Source: businessinsider.com

If the terms of the loan are less than a year, you can divide the APR percentage by 365 days. For the example above, the daily rate will be 0.03287. Multiply this rate by the sum you own, and you’ll receive the daily interest. In our example, it’s $32.87 for each $1000 of the debt.

How To Be Sure That You Will Pay Back Your Debt

The best way to ensure your security in unforeseen situations is to have an emergency fund you can use to pay back the loan. Multiple sources of income can provide some level of security because the probability that you will lose them all at the same time is lower than in the case of a single income.

But most of all, we recommend implementing meticulous financial management into your everyday life. On the basis of exact information about your earning and spending, you can evaluate the perspectives and find out the ways of paying back the debt.

The specialists advise keeping the total debt amount at the level when monthly payments are less than 30% of your total income. Otherwise, you’ll find yourself in a very difficult situation, and paying back will require much more sacrifices and effort.

Why Debt Trap Is So Dangerous

The debt trap means the situation when you are forced to take a new loan to pay back the previous. Please don’t confuse it with debt consolidation. The latter is a valid financial tool, and the first is the consequence of poor financial decisions and unpredictable emergency situations.

The main danger of the debt trap is in piling up your debts. This strategy leads to a constant raising of monthly payments, and soon you’ll have to apply for one more loan to cover the payments. So, if you are considering taking a loan for such a purpose, stop and think this through one more time. If there is another opportunity to get money, use it.

When you are in a debt trap, it’s extremely hard to improve the situation. So, turn back before you take the step into this hole.