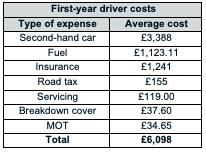

· The first year of driving costs just over £6k for the average Brit and takes 13 months to save up for

· The average second-hand car costs just over £3k and annual fuel expenditure hovers around the £1k mark

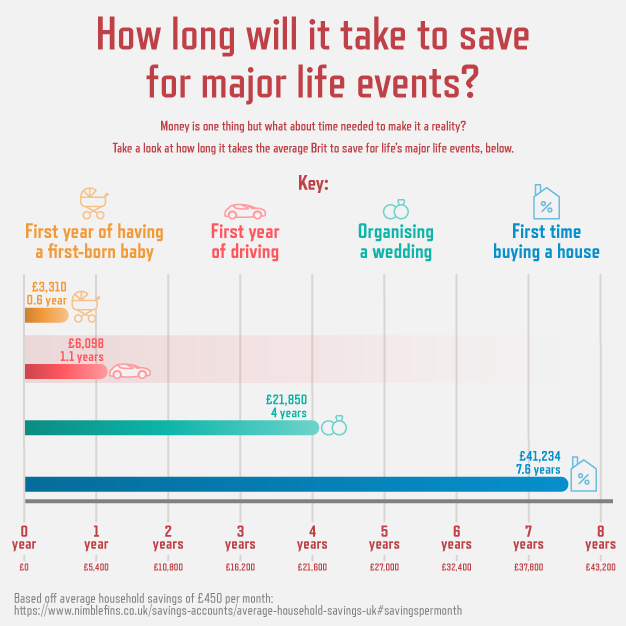

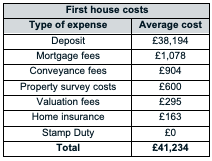

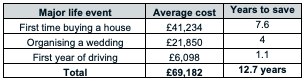

· Buying a first house is a whopping 576% more expensive than the first year of driving

· You’ll also need nearly eight years’ worth of savings to buy your first house

New research by Vertu Motors has found that Brits need to save just over £6K (£6,098) to afford to be a first-time driver for their first year in the UK.

The research compiled from more than 20 financial data sources (including Nimblefins and the Money Advice Service) also found that it would take the average first-time driver 1.1 years (or 13 months) worth of savings to afford to drive on British roads in 2021.

The annual costs calculation included buying a second-hand vehicle, new driver insurance, road tax, MOT, servicing, breakdown cover, and average fuel cost.

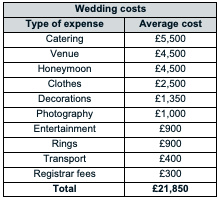

Planning a wedding, for example, is more than three times as expensive (£21,850) as the first year of driving. The costs for catering and paying for the venue alone are £10k on average – and that’s before the dress, the rings, the honeymoon, and decorations.

In fact, even just the average house deposit (£38,194) costs more than all the other major life events (first year of driving and organising a wedding) put together.

On the other hand, getting the money together to afford the first year of driving takes just over a year.

“The upfront costs that come with being handed your pink driving licence can feel daunting in the beginning. But our research has found that it is an achievable financial goal compared to other major life events.

“Of course, driving costs are by no means cheap, but learning to drive is a major milestone and a pivotal moment for independence.

“One thing is for sure: knowing how much life events, like learning to drive, cost and how long they take to save for will prove essential when it comes to actually making them a reality.”