Delaware vs Nevada: LLC Formation Comparison

The rules for establishing a limited liability company (LLC) vary on a state-by-state basis. The legal frameworks for starting and maintaining an LLC in Delaware are contained in the Delaware Limited Liability Company Act (DLLCA) and Nevada Limited Liability Company Act (NLCCA) respectively.

Delaware

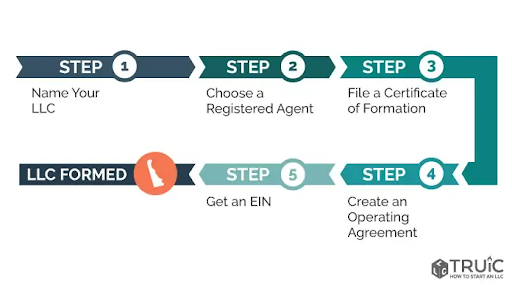

The first step in establishing an LLC in Delaware is selecting a name for the company that is compliant with the requirements of the aforementioned statute (DLLCA). Moreover, it requires that: ‘LLC’ must be included in the name, either in its entire or abbreviated form; it cannot contain words that might confuse the LLC with government; restricted words (i.e. bank, attorney) require additional paperwork and a respectively licenced individual (i.e. accountant, lawyer); and the name must be distinguishable from other Delaware LLCs. A name’s availability can be checked by searching the Delaware Entity Search on the Department of State’s website

The second step is the selection of a Registered Agent. This term refers to an individual or business entity that acts as the point of contact with the state. Their responsibilities can include, but are not limited to: receiving important tax forms, legal documents, lawsuit notices and official governmental correspondence on the behalf of the LLC. The only key requirements are that the Agent must: (1) maintain a registered office in Delaware; (2) be an individual, a Delaware-based LLC, or foreign LLC with a business address the same as the registered office address

The third step is filing for the certificate of formation. This certificate grants legal authority to an LLC’s name. The DLLCA statute provides several requirements for the formation of an LLC and the State of Delaware offers online and mail-in LLC filing to meet these requirements. The certificate of formation shall be filed in the office of the Secretary of State and will set forth: (1) the LLC’s name; (2) the address of the registered office and the name of the Registered Agent and (3) any other matters the members determine to include therein.

This fourth step is optional but highly advised. The DLLCA recommends new LLCs to create an Operating Agreement as it is good practice to have one. This is a legal document outlining the ownership and operating procedures of the LLC. This agreement is vital because its comprehensiveness ensures that all business owners are on the same page, reducing the risk of future conflict. Please note that operating agreements are limited by state statute, so it cannot be used to override or change this.

The final step is to acquire a Delaware LLC Employer Identification Number (EIN), also referred to as Federal Employer Identification Number (FEIN). This is a 9 digit number the IRS assigns to businesses for tax purposes; it’s essentially their equivalent of a social security number. An EIN is required to open a business bank account, file and manage federal and state taxes and to hire employees. It is a very simple process to acquire one: get one for free from the IRS online or through the post.

Comparison with Nevada

The LLC laws in Nevada remain largely similar to that in Delaware; it shares the majority of the steps albeit with slight differences. The same key conditions apply to LLCs when picking their names, it must contain LLC in full or abbreviation. LLCs must also have a registered agent that can be an individual or business entity as long as they are a Nevada resident or authorised to do business in Nevada with a physical street address there.

In Nevada, one must file an ‘Article of Organisation’ (instead of a Certificate of Formation in Delaware). In addition to the LLC’s name and the name, address and signature of the registered agent (the only two requirements on a Certificate of Formation), the LLC’s dissolution date, whether the LLC is run by managers or members, the name and addresses of each manager/managing member and the name address and signature of the LLC’s organiser are required

Just like in Delaware an operating agreement is not compulsory in Nevada, but is highly advisable. The requirement for an EIN is also identical to that in Delaware

The final distinction is the need for LLCs to submit annual reports listing their officers, directors and registered agents. The first of these reports the state calls an ‘annual list’ must be submitted with the Articles of Organisation, and annual lists are due by the last day of the month in which the LLC’s organisation falls.

Concluding Remarks

The rules for establishing an LLC are different in each state of the US. The differences between the processes in Delaware and Nevada are subtle but noticeable. The two states have different names for the document that must be submitted to legally authorise the LLC, in Nevada it’s called the Article of Organisation whereas in Delaware it’s the ‘Certificate of Formation’. Not only this, Nevada’s form requires extra information. Additionally, LLCs must submit annual reports in Nevada. The two processes are comparably simple to each other.