The 7 Things Every Due Diligence Data Room Must Include

Mergers and acquisitions (M&A) are extremely complicated processes where assets or entire companies are consolidated through a variety of financial transactions. While business leaders may be able to agree to the idea of an M&A transaction rather quickly, the due diligence process is much more time-consuming.

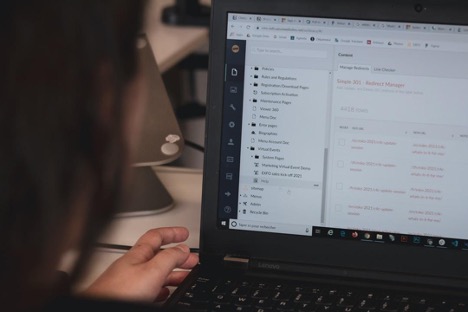

In this context, due diligence means reviewing a target company’s documents that detail their business processes, financial statements, and other confidential information. Gone are the days of sifting through files in a physical data room. Big data means that enterprises deal with too much information to analyze via traditional means. This is where virtual data rooms (VDR) come in to ensure that confidential documents can be accessed by anyone who needs them and to expedite the due diligence process. Here are seven things you should be on the lookout for when it comes to a due diligence data room.

1. Easy Organization

Outside of still having paper-based documentation, poor organization of sensitive documents in a data room is one of the most common causes for delays during an M&A deal. Good virtual data room providers make it easy to use their templates to set up folders for each of the interested parties during an M&A. For example, you can set up a folder for financial documents for accountants, or another folder for legal documents that any involved law firms can look over.

2. Full Control Over Permissions

A reliable online data room should also make it easy to assign an appropriate level of access to everyone involved in due diligence. This, naturally, ties in with the previous point of dividing documents based on who needs them. Assigning the right third parties to the right documents ensures that no one will see your sensitive data who doesn’t need to. Keeping tight control over permissions throughout your enterprise is the best way to keep information from falling into the wrong hands.

3. Security Certifications

Speaking of keeping corporate documents out of the wrong hands, you should only trust a data room provider who can demonstrate that they have at least the standard security certifications to protect data in a virtual data room. These include the following:

- SOC 1/SSAE 16/ISAE 3402

- SOC 2 Type II

- FISMA, DIACAP and FedRAMP

- HIPAA/ITAR

- DOD CSM Levels 1-5

Most of these are standard security measures, although HIPAA and ITAR regulate patient information in healthcare and services developed for military use, respectively. Due diligence software isn’t worth much if you can be ensured that it’s a secure space, after all.

The security for VDR also makes it a better option for enterprises than traditional sharing options like Dropbox or Google Drive. You never know how secure someone else’s connection is, and you can’t conduct document audits with non-enterprise options.

4. Optional Security Features

A great due diligence data room should also provide options beyond the standard security features. You want to be sure that anyone viewing your documents is who they say they are, after all. This is why it’s a good idea to take advantage of additional features, like multi-factor authentication (MFA).

As the name suggests, this type of security requires more than one set of credentials to gain access to necessary documents. An example could be a biometric requirement, like a fingerprint, in addition to a username and password.

5. Document Tracking

Another great advantage of a good virtual data room service is that you can actually track documents you upload and tell who’s accessed them and when. If you’ve enabled document downloads, you’ll get notifications about those, too. This way, you can see what documents are being actively reviewed and determine if there are any delays in due diligence.

6. Digital Rights Management

Digital rights management (DRM) tools have long been important for creators of intellectual property, but they’re also crucial for enterprises who want to prevent unauthorized access to or use of their documents and images.

A VDR with built-in DRM capabilities allows you to revoke access to documents, even if a user has already downloaded them. This is crucial for the end of the M&A process to ensure that only authorized company team members have ongoing access to due diligence documents.

7. Free Trial

If you still aren’t totally convinced of the benefits of a due diligence data room, seek out a VDR provider who offers a free trial of their service. This way, you’ll have a risk-free opportunity to test out the features and see if it’s the right solution for your enterprise needs.