Despite impact of COVID-19, homebuyers still intend to purchase property

Toronto, ON, Canada, May 18, 2020 – The coronavirus pandemic dampened the spring homebuying season but, despite a drop in sales activity, it appears buyers still intend to purchase homes this year and into the near future.

A recent survey by Zolo shows that even with higher unemployment and uncertain business conditions, buyers still intend to find and buy a residential property either this year or in the near future.

According to the survey, which polled over 2,100 North American households between April 15 to 17, 2020, respondents reported no significant change in their plans to buy a home with 47% planning on buying within the next five years, and another 16% planning to purchase this year.

Buyers are interested in this market because they see an opportunity to get into a home at a discounted price, with many expecting a 5% to 10% drop in purchase price if buying this year. In Vancouver, that’s more than $100,000 off the Canadian Real Estate Association’s benchmark price, as of March 2020. In Toronto, the expected price cut is closer to $87,000.

Millennials appear most optimistic

Of the more than 2,100 respondents, more than 51% were millennials (between the ages of 25 and 39). These respondents appear most optimistic about the purchase of a home, with 30% planning on buying a home in two to three years (16% plan on buying in 2020, while 21% plan on buying within four to five years).

The top three reasons for purchasing a home, even during the pandemic, are to stop paying rent (27%) because the home buyer has started or intends to start a family (26%) or a desire for “permanence and stability” (20%).

Prior to the pandemic, 59% of millennials were saving for a home, and 51% of Gen X buyers were saving for a property purchase. After the economic setbacks brought on by COVID-19, 53% of millennials continue to save for a down payment on a home, while only 39% of Gen X buyers continue to sock away cash for a down payment.

Turns out more than half (53%) of the millennial respondents were unwilling to buy a home that would force them to spend more than 30% of their income on housing. Gen X buyers were even more unwilling to exceed this budget constraint with 61% reporting they would not buy a home that forced them to pay more than 30% of their income on housing.

This diligence about saving for a property purchase may be fuelled by greater awareness about the impact of debt and the dangers of being house-rich and cash-poor.

Still, the near-future still holds a number of obstacles for millennial homebuyers. According to survey respondents, the biggest obstacle for millennials buying a home was the need for a larger down payment (33%) followed by the possibility of losing their job (29%).

Gen X Buyers Still Want Stability

While Gen X Buyers (those aged 34 to 54) appear to be putting their home-buying dreams on hold, they don’t appear to be as worried about their employment. According to respondents, the largest obstacle to purchasing a home was not having a large enough down payment (42%), while the inability to qualify for a mortgage (30%) was the next big hurdle.

The two biggest reasons Gen X buyers want to purchase property are to “stop renting” (40%) and to establish some “permanence and stability” (25%).

Online home buying experience

Prior to the pandemic, a few tech-savvy real estate brokerages, such as Zolo, were already making the transition to a mobile-friendly home-shopping experience. This emphasis on virtual and online experiences throughout the process of buying and selling a home was made all the more acute as soon as social-distancing and self-isolation became a requirement in order to slow the spread of COVID-19.

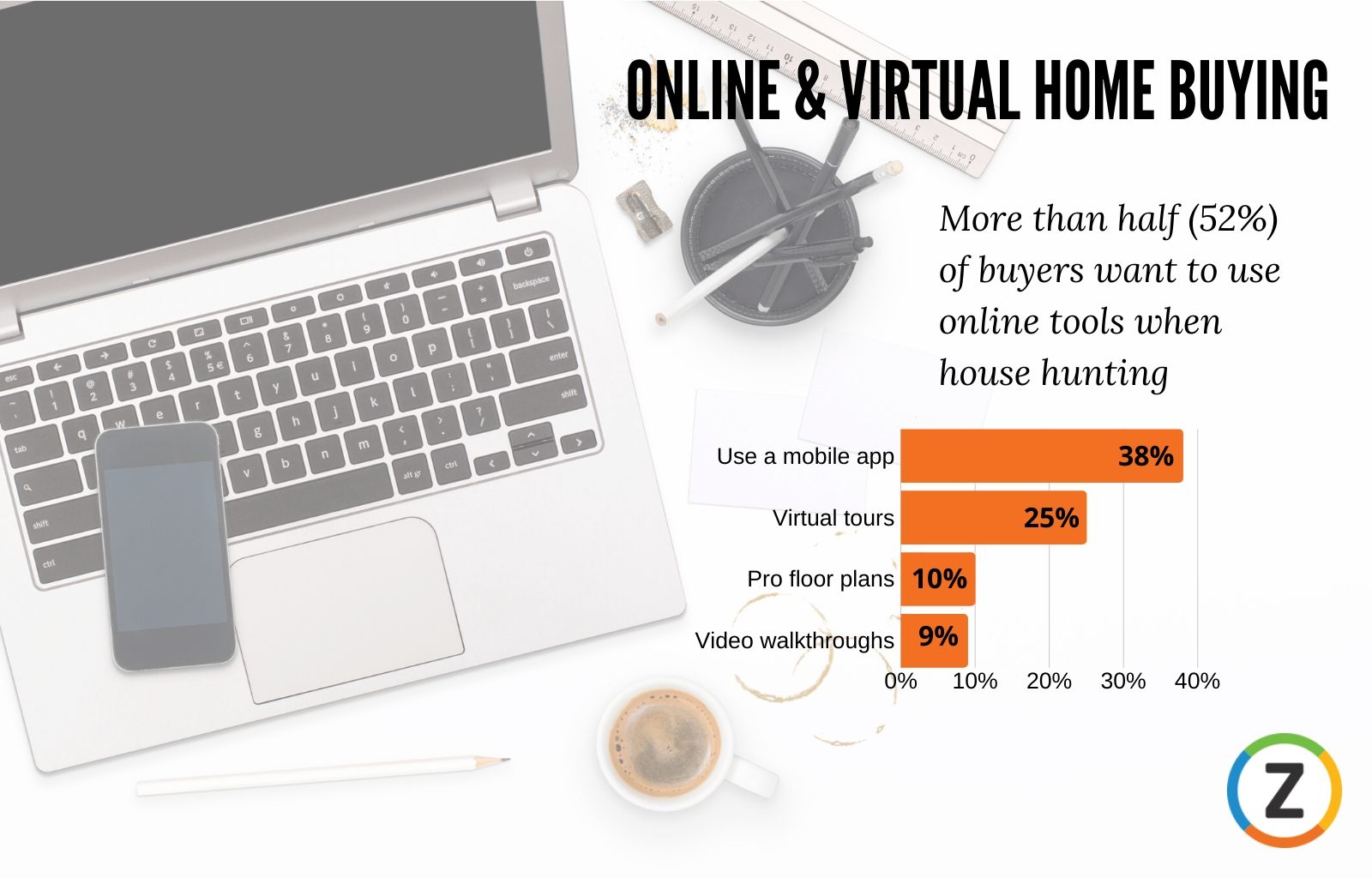

Turns out, buyers were waiting for this nudge into the virtual world, with 52% of the respondents reporting that they would “prefer to complete the entire home buying process using only online tools.”

- 50% of Gen Z (aged 18 to 24) buyers would prefer an entirely online home buying experience

- 53% of Millennial buyers would prefer an entirely online home buying experience

- 53% of Gen X buyers would prefer an entirely online home buying experience

- 49% of Baby Boomers would prefer an entirely online home buying experience

When searching for a new home, buyers still overwhelmingly preferred the option of working with a Realtor (48%) and many still wanted to attend an open house (35%); however, 38% would use a mobile app, 34% would use virtual tours or pre-schedule video walkthroughs of the property and another 10% wanted access to professional square-footage floor plans (multiple responses allowed).

Real estate sales activity virtually stopped in mid-March and throughout April, however many Realtors and mortgage brokers were reporting an increase in inquiries from buyers and sellers regarding the best approach to enter the market, this year.

“There’s no doubt, the real estate market came to a standstill because of COVID-19 and the resulting economic impact,” says Romana King, director of content at Zolo, and an award-winning columnist and real estate expert. “But it doesn’t appear as if buyers have soured on the idea of homeownership. For many homeownership is still the cornerstone of financial stability.”

It will take a few more months for market data to provide a clearer picture of COVID-19’s impact on home prices — and in that time, market stakeholders could find their feet in this technologically-driven world.

Survey results

The findings of the Zolo Homebuyers Intentions Survey are based on an online survey conducted by Zolo.ca between April 15 to 17, 2020, of 2,128 respondents who live in North America. The estimated margin of error is +/- 2.12 percentage points, 19 times out of 20.

To download images and raw data, please go to: https://drive.google.com/drive/folders/1lplJG4nJfcV4sHGxZLOU4wDckf73ekVf?usp=sharing

About Zolo

Zolo is one of Canada’s most popular online national real estate marketplaces. Each month, more than 9 million buyers and sellers start their real estate search using Zolo. As a tech-disruptor and largest national brokerage, Zolo provides users with the data and resources needed to make better-informed property decisions.

About Romana King

Romana King is an award-winning personal finance writer and real estate expert. She writes for big banks, insurance providers, newspapers along with businesses. Romana speaks on real estate issues, estate planning, property & taxation, as well as personal finance.