These are the most common misconceptions Brits are still trying to figure out

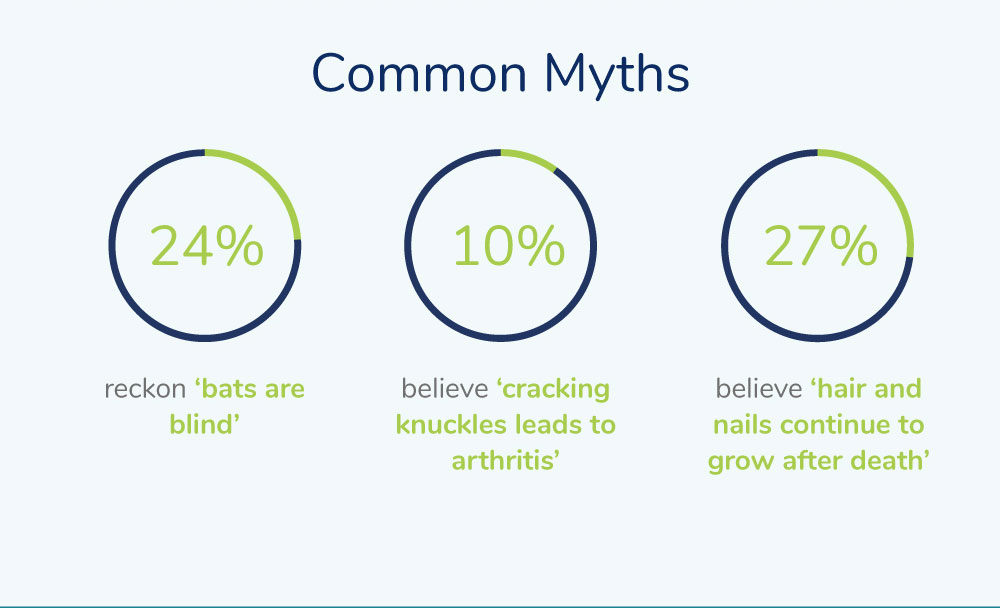

‘Does sugar make children hyperactive?’ and ‘are bats blind?’ are among the brainteasers Brits are still trying to figure out.

Other things which confuse the nation is ‘whether food is safe to consume if it’s been on the floor for less than five seconds’.

A poll of 2,000 adults also found almost one third think ‘buying is always better than renting’ while one in 10 believe cracking knuckles leads to arthritis.

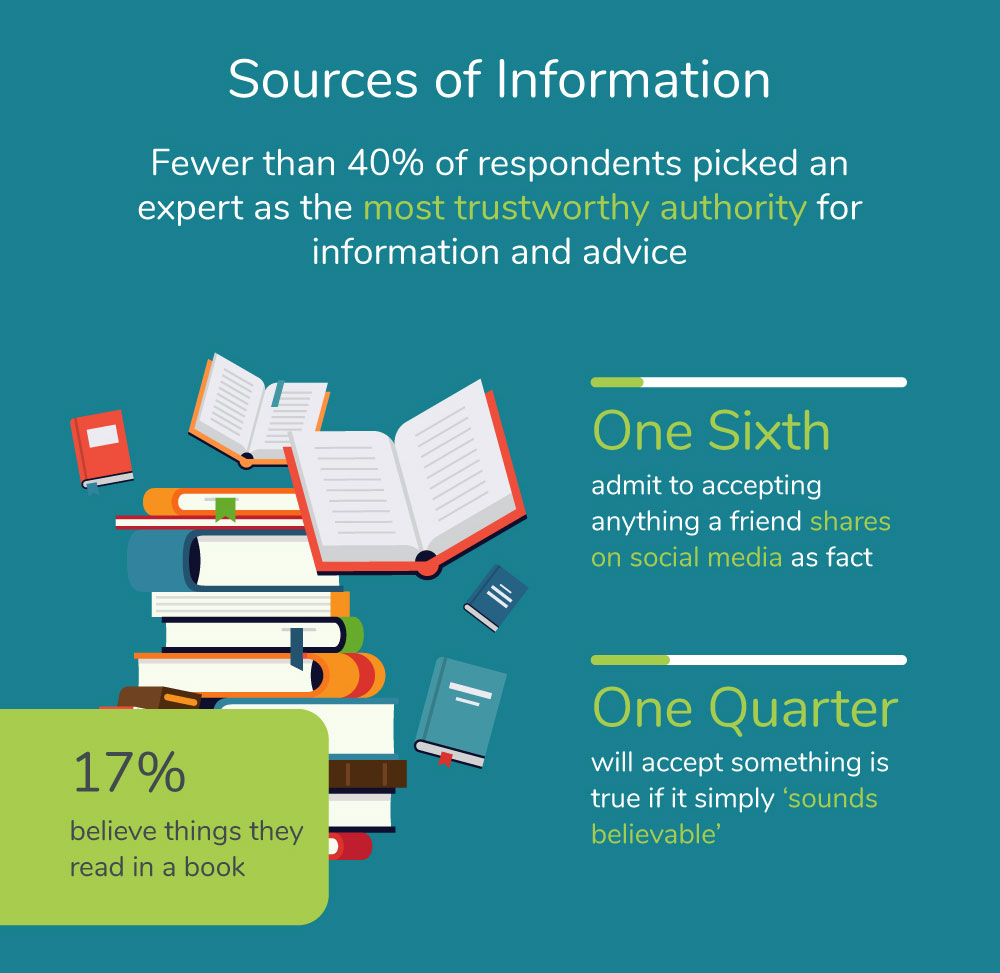

When it comes to sources of information, fewer than 40 per cent of respondents picked an expert as the most trustworthy authority for information and advice.

One sixth admitted accepting anything a friend shares on social media as fact.

The same number said they will believe something if their mum tells them while more than one quarter will accept something is true if it simply ‘sounds believable’.

The internet, books and partners were also classed as trusted sources.

The research was commissioned by Lowell.

Managing director John Pears said: “People still believe some strange things.

“Whether this is because old wives tales have been passed down from parents or stories seen on the internet or friends have shared them, it’s often hard to differentiate

between fact and fiction.

“Old wives’ tales are often harmless but some untruths can affect your wealth or your health.

”It’s important to get the right information advice from experts, who know how to help.

The research also identified misconceptions about money.

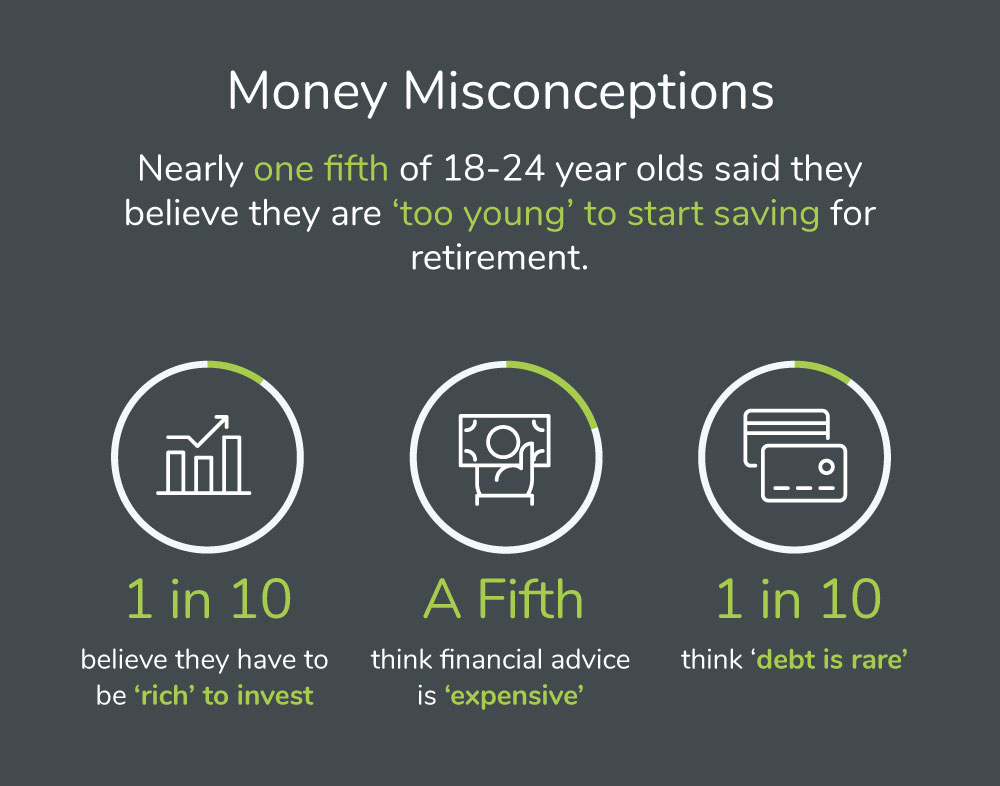

Nearly one fifth of 18-24 year olds said they believe they are ‘too young’ to start saving for retirement.

A further one in 10 adults believe they have to be ‘rich’ to invest and one fifth thinks financial advice is ‘expensive.’

However, a financial advisor was who people were most likely to seek money advice from, but two in 10 would look to the internet and their partner for finance tips.

When it comes to money woes there is lots of confusion, with one in 10 thinking ‘debt is rare’.

Almost two thirds ‘fear’ being in debt and three in 10 said listening to the wrong advice in the past has cost them financially.

More than three quarters believe all debt should be paid off before retirement and

almost half consider debt to be a joint responsibility between married couples.

Over one quarter of Brits polled via OnePoll believe ‘credit’ is a useful tool while three in 10 think it is something that should only be used for larger purchases.

As well as financial consequences, trusting something which turned out to be false led to one in 10 suffering from lack of concentration, tiredness and even depression.

A further one in five have endured sleepless nights and stress due to believing untrue information.

Blogger and finance expert Emma Bradley said: “With the research suggesting many of us don’t trust experts and preferring friends on social media to specialists, it is time to reframe where we get our information from.

“We have lost trust in experts and often feel they don’t tell us the whole truth or that they have an ulterior motive especially where money is concerned, it seems we trust people like ourselves more but this can be problematic.

“Expert are qualified and have extensive experience on a topic, when it comes to finance we also need experts as they are able to break down jargon and explain it in terms that we understand.

“We live in a technological society where we can find out information ourselves, but do we understand it? And is it accurate?”

Pears added: “As people who help people manage their credit better, we know there’s a lot of misinformation and confusion around debt and money in general, which can lead to other problems.

“Saving is one of the best ways to avoid debt becoming a problem in the first place. You’re never too young or too old to start, and there’s financial advice for all situations.

“Over eight million people in the UK are dealing with debt, so contrary to what many believe it’s not rare to be in debt.

“We all use credit at some time and mostly without issue, but things can change when you least expect them.

“As with many worries in life, the right help can make things so much better; talking to someone that understands the issue could mean dealing with a problem isn’t as scary as you might think.

“The truth is that the sooner you speak to experts about a problem the sooner you can find an answer that’s right for you, and the sooner you can remove any stress or anxiety.