Researchers find that money can buy happiness – its an extra £508 a month

Happiness is an extra £508 a month say Brits, a study has found.

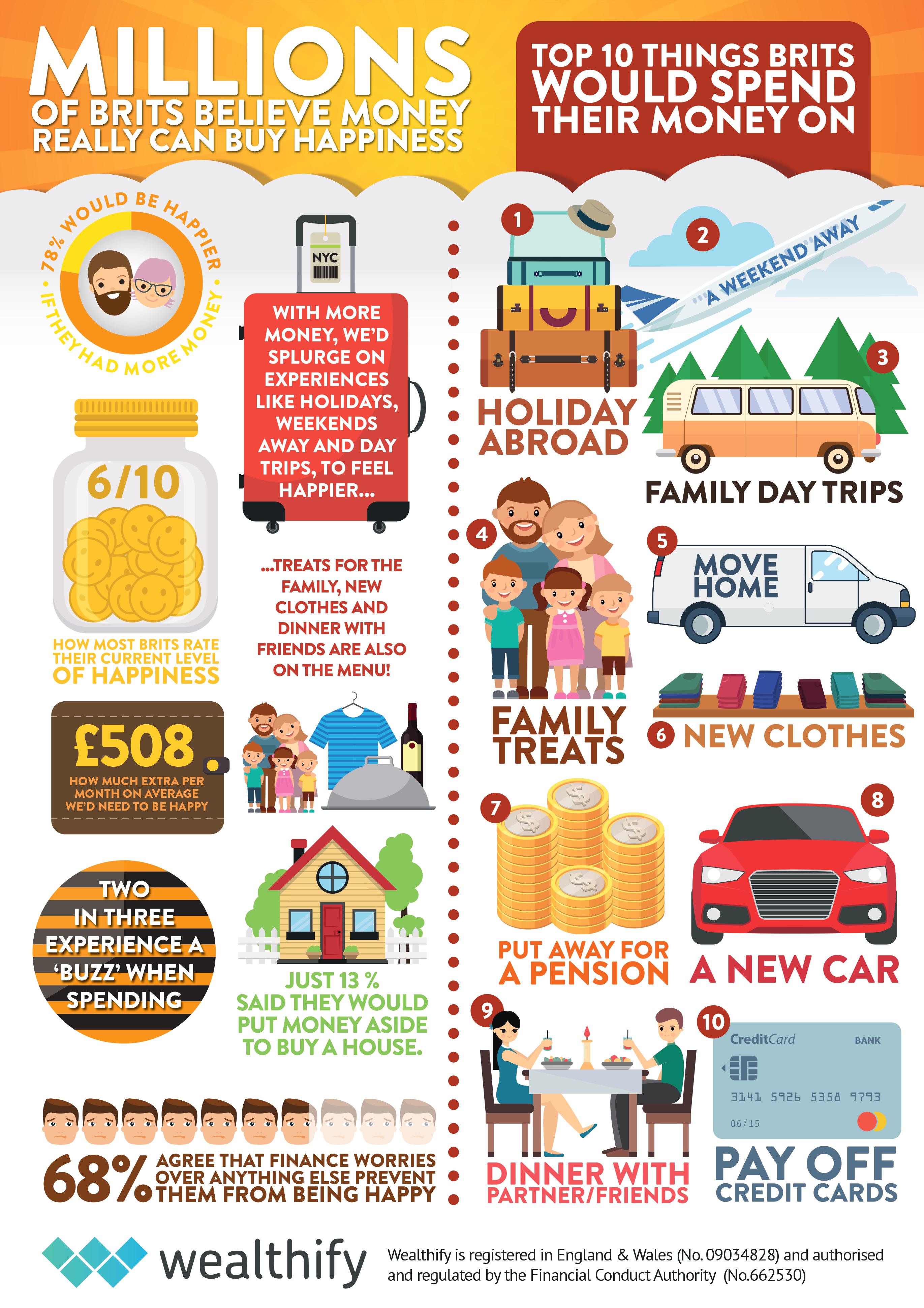

A poll of 2,000 adults revealed money really can buy you happiness – but in contrary to common belief we don’t need millions to put a smile on our faces.

More than three quarters of those who took part said they would be happier if they had more money to splurge on a holiday abroad, weekends away or day trip with the family.

The research also found Brits rate their current ‘level of happiness’ as a modest six out of 10, but 87 per cent agree a bit more cash would make things better.

It also emerged 68 per cent agree that worrying about money is what prevents them from achieving true happiness.

Michelle Pearce, chief investment officer at Wealthify, which commissioned the survey, said: “Our research came out with some fascinating results, proving the importance money plays in people’s lives, in helping to ease stress.

“But what people may not realise is, you don’t need piles of money in the bank to plan for a happier future – you can start with small sums and build it up with regular deposits in order to grow your finances and feel more in control.”

Researchers also found millions of Brits would spend extra cash on treats for their family, new clothes or dinners with friends to brighten their mood.

Others would spoil themselves with a massage, a new hairdo or even just nicer food to stock up the kitchen cupboards.

Just 13 per cent said they would put money aside to buy a house.

The study also found Brits are far more inclined towards instant gratification than thinking about the future when it comes to money.

And millions prefer to spend extra cash on things to make themselves happier right now, over using it to pay off debts, or save for the future.

More than two thirds of the nation have spent money in the past and found they felt happier as a result.

And seven in 10 admit they get a sense of enjoyment simply from looking forward to using their new purchase regardless of whether it’s new clothes, a car or even a washing machine.

Others get joy from decorating their bedroom, splashing out on a new hobby, joining the gym or putting away for their pension.

But with this ‘spending buzz’ lasting just a few days for most Brits, it’s no wonder one quarter like to make smaller, regular purchases over high-value rare treats, feeling happy more often as a result.

However, over two thirds report they typically feel a stronger sense of joy when buying larger items, so it seems that the more you spend the more happiness you can buy.

The research also found three in ten agree spending money helps ease the worries of modern life, bringing happiness as a result.

Fretting over paying the bills, the rent or mortgage and getting out of debt are some of Brits’ biggest worries in life.

With others agreeing their job security, appearance and relationship with their other half are among their greatest concerns.

The study, conducted via OnePoll.com, also found financial worries cause arguments between Brits and their partners.

There seems to be some disagreement as to exactly what it is about money that makes people happy.

One in 10 say it’s the act of spending money, while 76 per cent said they would be less stressed if they had more cash in the bank.

The research also supports the commonly-held belief that rich people are happier than poorer people.

The study revealed those with a disposable income of £1,251 or more a month rate their current happiness an eight out of 10, compared to those with less than £100 a month who gave their lives a happiness rating of just six out of 10.

And over half of respondents said they assume that people with more money than them are more satisfied with their lives.

It seems Brits could use some help when it comes to managing their finances, too.

Fifty-eight per cent of the nation agree they could be better with money, while 12 per cent admitted to being no good at all at handling their finances at all.

Worryingly, just 30 per cent of those surveyed believe they will one day reach a point where they have enough money to make them happy.

Young people aged 18-24 were found to be the most optimistic about their financial futures, with more than half saying they believe they will achieve happiness.

While almost the same percentage of over 55s, said they probably won’t.

Michelle Pearce added: “It’s somewhat concerning that so many feel that they will never reach a point where they have enough money to be happy.

”But, then again, it’s hardly surprising given the current state of savings rates in the UK, and rising inflation eating into returns.

“However, people shouldn’t despair. They could reach a point where they’re financially comfortable, it just takes a bit of discipline to start a good regular savings habit over the long-term.

”And, if they’re willing to accepting a little risk by investing their money, all the better. £50 a month put aside over 30 years, for example, will amount to £18k.

”But invested in a medium risk Plan, that could grow to over £48k, showing that small deposits little and often, can grow exponentially over time thanks to compound returns.

“Contrary to what many people think, you don’t need lots of money or experience to start investing, either – there are low-cost and convenient services available that will build and manage your investments for you.

”And if you struggle to find cash left over at the end of the month to put aside, simply setting up a direct debit or standing order to come out on payday, will stop you spending it on something else.”

Top 20 things Brits would spend their money on to make them happy:

1. A holiday abroad

2. A weekend away

3. Day trips with the family

4. Treats for my family like lunch out

5. Move house

6. New clothes

7. Put away for money for a pension

8. A car

9. Dinner with partner/friends

10. Pay off credit card debt

11. Nicer food for the home

12. A new kitchen

13. Pay off more off my mortgage

14. A laptop/computer

15. Going out for drinks

16. Put away money for a deposit for a house

17. Pay off loans

18. Decorate the living room

19. Decorate their bedroom

20. New shoes